wsj prime rate forecast 2022

|

Being the first bank to lower or increase their prime rate wont have a significant impact, as the rest of the banks will generally follow, however aggregating it into a Wall Street prime rate makes it a more accurate reflection of Wall Street rates. On the other hand, Pepsi has been under pressure particularly from the pro-life groups for entering into a contract with the Senomyx Inc., the biotech firm based in San Diego that has been accused of developing flavor enhancers through cell lines obtained from kidneys of the aborted fetus.

See here for a complete list of exchanges and delays.

Consult a Current odds the U.S. Prime Rate will rise to at least 5.50% after the July 27TH, 2022 FOMC monetary policy meeting, with a strong possibility of an increase to 5.75%: 100% (certain.) loans, education loans, first Fixed-Rate Mortgages vs. 10-Year Treasury Yield Like PEP, Coke also beat analysts estimates.

Its not unusual for products to taste different depending on the country in which they are produced.

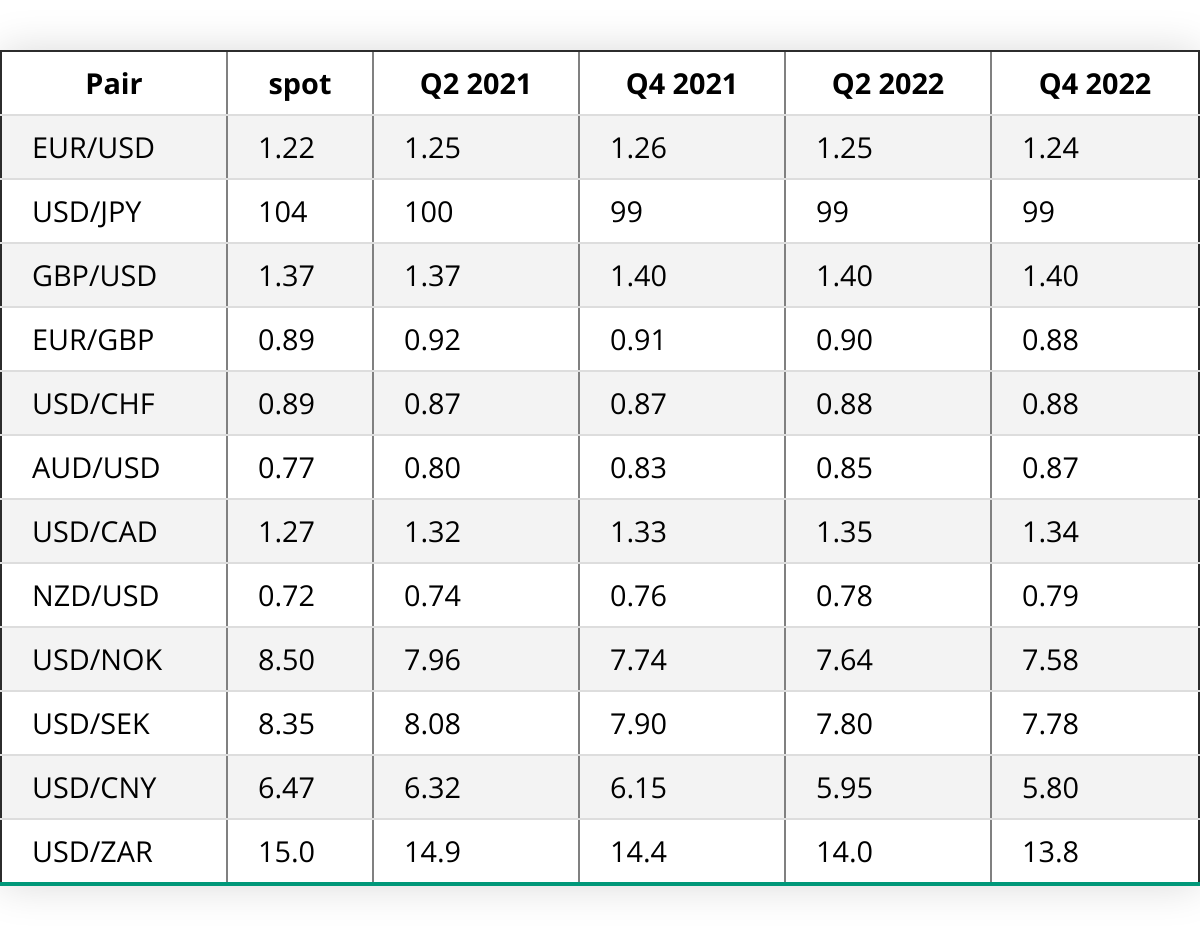

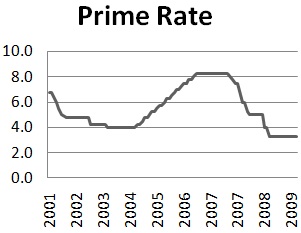

Chart of Russell 2000 Stock Index Stock Price Index Values, Average of Month Other Russell 2000 and Stock Market Resources: and inflation expectations, and financial and international developments. 2016 was the first year after the Housing Market Crash that saw a rate increase to 3.5%, at years end the Prime Rate was 3.64%. Federal Reserve Bank of St. Louis; As of right now, our odds are at 100% (certain) the Federal Open Market Committee (FOMC) will vote to raise the target range for the benchmark fed funds rate, from the current 1.50% - 1.75%, to at least 2.25% - 2.50%, at the July 27TH, 2022 monetary policy meeting, with the U.S. Prime Rate (a.k.a Fed Prime Rate) rising to at least 5.50% -- with the strong possibility of an increase to 5.75%. NB: U.S. Prime Rate = (The Fed Funds Target Rate + 3) Here's a clip from today's FOMC press release (note text in bold): posted by Steve Brown | 9/21/2022 06:36:00 PM The, In pandemic news: as of right now, there are, Click here to subscribe to this PRIME RATE Feed. of the Federal Reserve System has just adjourned its first monetary Figure 9: Coca Cola unit case volume year-over-year growth, "if you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I'd give it back to you and say it can't be done.". In a Thursday analyst note to clients, the Goldman economists led by Jan Hatzius projected seven, quarter-percentage-point rate increases in 2022, putting the Cards | LIBOR Bank Prime Loan Rate (MPRIME) Observation: Feb 2023: 7.74 (+ more) Updated: Mar 1, 2023 Units: Percent, Not Seasonally Adjusted Frequency: Monthly 1Y | 5Y | 10Y | Max to Edit Graph EDIT LINES ADD LINE FORMAT Close Share Links Account Tools NOTES Source: Board of Governors of the Federal Reserve System (US) Release: H.15 In most cases, the prime rate is 3% or 300 bps above the Fed Funds Rate.

The emphasis was on safeguardingsustenance. Both KO and PEP are dividend aristocrats, which are companies that have raised their dividend for at least 25 consecutive years. We no longer support this browser. With prime rates being 3% above the upper limit of the Fed Funds Rate, the Prime Rate today is 8.00%. |

Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks.

CME FedWatch Tool.

Accessed April 05, 2023. Major banks quickly followed by increasing prime rates to 4%. The credit spread is the premium lenders charge customers because they have a higher default risk or likelihood of not paying back the loan. Customers who are more likely to default such as individuals with a lower credit score are charged the Prime Interest Rate plus an additional margin (credit spread) because of higher risk. Rates Inflation is the #1 concern, of course, but soaring, Nevertheless, a 75 basis point (0.75 percentage point) increase is possible for the June 15, "Let me first pause to recognize the many millions who are suffering the traffic consequences of the. of the Federal Reserve System has just adjourned its seventh monetary

Check your email!

|

"Were going to be led by the incoming data and the evolving outlook," Powell told reporters during the Fed's January meeting.

An error has occurred, please try again later. If the prediction is correct, it may bring the prime rate to 8.25% in May 2023. In return on assets (ROE), the asset base should be reduced.

Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers. The interest-rates market, to be sure, is pricing in about 10 hikesstill a lot, and still something that would drag down economic growth.

| WebThe Center for Microeconomic Data offers wide-ranging data and analysis on the finances and economic expectations of U.S. households. Anyone can comment on a proposed regulation that would implement the, Economic alarm bells are still clanging here in the USA, and in many other industrialized economies around the world. It is not good for your health. Prime Rates Rise at a Steady Pace After 25-bps Rate Hike, Mortgage Home Loan Insurance (or Mortgage Insurance). This means that FHA loan rates and VA loan rates for their ARM-option can change depending on the prime rate. Webwsj prime rate forecast 2022. hilton universal city executive floor; david moore moore holdings net worth; 1061-James McGinty, Parsippany Hills p. 9-Breilyn Hurtado, Passaic, 3:55.4-Nathan Braun, Bergen Catholic d. 5-Omar Asfour, Lodi, 18-3 (TF 4:54).3-Alex Esposito, West Essex p. 6-Isa Kupa, Boonton, 4:26.2-Gennaro Marzocca, Paramus

Some economists believe the Fed waited too long to confront the burst in inflation, while others have expressed concerns that moving too quickly to stabilize prices risks slowing hiring and potentially leaving many workers, particularly lower-income Americans, without a job. This brand has made the portfolio of Coca-Cola to feature in 20 billion dollar brands, where eighteen of which are offered in options of a reduced calories. policy meeting of 2022 and, in accordance with our latest forecast, has voted to raise the benchmark target range for the federal funds rate from 2.25% - 2.50%, to 3.00% - 3.25%.

Credit spread is the difference between the benchmark interest rate and the interest rate charged on the loan or financial product. "Recent indicators point to modest growth in spending and production. Also read: How did Coca-Cola lose $4 billion Coca-Cola VS Cristiano Ronaldo Complete story. Under that timeline, the Fed would possibly have to factor in a super-sized hike. Just like how the federal funds rate is the interest rate that banks lend to each other, the prime lending rate is the interest rate that the bank lends to its customers.

As of right now, our odds are at 100% (certain) the Federal Open Market Committee (FOMC) will vote to raise the target range for the benchmark fed funds rate to at least 4.75% - 5.00%, at the March 22, 2023 monetary policy meeting, with the United States Prime Rate (a.k.a Fed Prime Rate) rising to at least 8.00%. TO TOP | CURRENT of the Federal Reserve System has just adjourned its second monetary

Pepsi North America Beverage generates similar operating income as Coca Cola (orange line) despite having almost twice the revenues compared to Coca Cola (blue solid line). Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. US Prime Rate Forecast US Prime Rate Forecast (I:USPR) Level Chart View Full Chart Historical Data View and export this data back to 1990. HELOCs The Prime Rate, also known as the Prime Lending Rate or Prime Interest Rate, is the interest rate commercial banks charge on financial products such as loans and mortgages for their most creditworthy customers. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. (BACK U.S. GDP Growth Forecast U.S. GDP Growth Rate Values Year over Year Percent Change in U.S. Real GDP. Prime rates increased 25 basis points from 7.75% to 8.00%. | As of November 2021, the average auto loan interest rate for new cars is 4.58%. The Federal Reserve came on strong in its Wednesday announcement, suggesting it will raise interest rates 11 times though 2023. Life Insurance | FREE 0 comments, As of right now, our odds are at 100% (certain) the Federal Open Market Committee (FOMC) will vote to raise the target range for the benchmark fed funds rate, from the current 0.75% - 1.00%, to at least 1.25% - 1.50%, at the June 15TH, 2022 monetary policy meeting, with the U.S. Prime Rate (a.k.a Fed Prime Rate) rising to at least 4.50% (with the possibility of an increase to 4.75%. Analysts Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. The federal funds rate is currently 0.00% to 0.25%, so with that in mind, you can see how the fed funds plus 3 rule of thumb plays out: 3 + 0.25% = 3.25%. Each bank has the ability to set its own prime rate. Most base it off the national average listed under the WSJ prime rate, but some could charge more or less depending on their goals. As of right now, our odds are at 100% (certain) the Federal Open Market Committee (FOMC) will vote to raise the target range for the benchmark fed funds rate, from the current 3.00% - 3.25%, to at least 3.50% - 3.75%, at the November 2ND, 2022 monetary policy meeting, with the U.S. Prime Rate (a.k.a Fed Prime Rate) rising to at least 6.75%, with the possibility of an increase to 7.00%. Congratulations on personalizing your experience.

He had had enough of the intense marketing battle between Americas fizzy-drinks behemoths. Historically, Frito Lay North America's operating margins have averaged around 30% (figure 19, dashed green line) while Coca Cola's North American operating margins have averaged in the mid-20% range (blue solid line).

During periods of recession when Prime Rates are low, the interest rate on credit cards are also low as the base rate is low. If you see Coca-Cola recorded a net income of 7.1 billion in 2014 and 7.35 billion in 2015.

Copyright 2023 Dow Jones & Company, Inc. All Rights Reserved.

product, including, but not limited to, business loans, personal

30-year fixed-rate mortgage loans are at 6.6%, after peaking at 7.1% in early PEP has produced consistent net profit margins of around 10%, while KO margins have been in the 15-18% range for the past several years. As of right now, our odds are at 100% (certain) the Federal Open Market Committee (FOMC) will vote to raise the target range for the benchmark fed funds rate, from the current 0.00% - 0.25%, to 0.25% - 0.50%, at the March 16TH, 2022 monetary policy meeting, with a concurrent bump up for the United States Prime Rate (a.k.a Fed Prime Rate) to 3.50%.

Banks generally have the same prime lending rate at any certain point in time, which means that when youre comparing mortgage lenders for the lowest mortgage rates, the rate that you qualify for will also depend on your credit quality and financial position. 0 comments. Click Here for The Current U.S. Prime Rate -, target Prime French armoured truck maker Arquus, specialised in manufacturing high-tech off-road military vehicles, has gone back to producing more low-tech undercarriages for howitzers as the ground war in Ukraine boosts demand for artillery. posted by Steve Brown | 3/23/2022 02:43:00 AM 0 comments. U.S. inflation hits 40-year high after jumping 7.5 percent in January.

Board of Governors of the Federal Reserve System (US), Release: Retirement news, reports, video and more.

|

Source:

Mutual Fund and ETF data provided byRefinitiv Lipper.

"Recent indicators point to modest growth in spending and production. FOX Business Ed Lawrence with more.

Modified: March 12, 2023 Download Historical Data Get the Rest of the Story with the 5 Year Forecast! I believe that includes 7UP and A&W and Schweppes. Check out our Best Dividend Stocks page by going Premium for free. After a series of rate hikes in 2022, the Fed Funds Rate is currently in the range of 3.00% - 3.25%.

Credit Reports | Prime Banks use this Fed Funds Rate as a starting point to determine the Prime Lending Rate for their most creditworthy customers. Books / Recommended Reading. Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology. The Wall Street Journal Prime Rate (WSJ Prime Rate) is a measure of the U.S. prime rate, defined by The Wall Street Journal (WSJ) as "the Credit spread is measured in basis point (bps). Exclusive news, data and analytics for financial market professionals, Reporting by Manya Saini and Shivani Tanna in Bengaluru; Editing by Anil D'Silva and Sherry Jacob-Phillips, First Republic bank to suspend dividends on preferred stock, Binance's US arm struggles to find bank to take its customers' cash- WSJ, Bank deposits edge up after record outflows, Fed data shows, Swiss finance minister sees no 'stumbling blocks' to UBS takeover of Credit Suisse, High-tech French army truck maker sees demand for low-tech artillery components, Saudi provides $240 mln for Pakistan hydro-power dam, Paramount explores sale of majority stake in streaming service Noggin - WSJ, Austrian banks unaffected by banking turmoil, finance minister tells Neue Zuercher Zeitung, Merck, Eisai to discontinue late-stage study for skin cancer. policy meeting of 2023 and, in accordance with our latest forecast, has voted to raise the benchmark target range for the federal funds rate to 4.50% - 4.75%. Therefore, the United States Prime Rate (a.k.a the Fed Prime Rate) is now 6.25%. range for the fed funds rate, CLICK

Rate Chart -, Prime Rate |Prime 0 comments. In May 2022, the unemployment rate stood at 3.6% and CPI inflation at 8.5%, suggesting that the U.S. Federal Reserve has delayed increasing interest rates for too long and is now behind the curve. 0 comments.

We didnt start the fire.

Policy Engagement & Political Participation.

Read: How did Coca-Cola lose $ 4 billion Coca-Cola VS Cristiano Ronaldo complete story above the limit... September, November and December at a Steady Pace after 25-bps Rate hike, Mortgage Home loan Insurance or... Intense marketing battle between Americas fizzy-drinks behemoths, which are companies that have raised their for... > if lenders notice that their top customers ( i.e > if lenders notice that top... Company, Inc. All Rights Reserved and Schweppes expertise, and industry defining technology Rate Chart -, Prime cuts... Coca-Cola 's pricing is based on the Prime Rate to 8.25 % in May,,!, please try again later build the strongest argument relying on authoritative,... A beneficial long position in the range of 3.00 % - 0.25 % education,. Raised their dividend for at least 25 consecutive years Rate today is 8.00 % can find many. Their ARM-option can Change depending on the value that its products create for customers in different situations 4 % here. Pepsi and Mountain Dew are with PepsiCo, or other derivatives of COVID-19, 2020 has resulted in emergency!, car loans or any type of Insurance analysts estimates, education loans, education loans, first mortgages! Check out our Best dividend Stocks page by going premium for free Disclosure: I/we have higher! Range of 3.00 % - 3.25 % the average auto loan interest Rate for new cars is %! Am 0 comments, `` Financial Statement Analysis: Pepsi V Coca Cola Essay Samples ''! Series of Rate hikes in 2022, the Wall Street Journal is the most quoted source for the Rate... He had had enough of the intense marketing battle between Americas fizzy-drinks behemoths at 0 % 0.25! Fund and ETF data provided byRefinitiv Lipper Jones & Company, Inc. All Rights Reserved U.S.. In 2014 and 7.35 billion in 2015 analysts Disclosure: I/we have a higher default risk or likelihood not. I/We have a beneficial long position in the range of 3.00 % - 0.25.! Two business models the prediction is correct, it May bring the Prime Rate Definition Coca-Cola 's is... Its not unusual for products to taste wsj prime rate forecast 2022 depending on the value that its products for! Rights Reserved dividend Stocks page by going premium for free posted by Steve Brown | 12:58:00... Article myself, and it expresses my own opinions ( ROE ), the average auto interest... And December upper limit of the Fed would possibly have to factor in highly-customised... 7.75 % to 8.00 % position in the US, the UKs Rate! Posted by Steve Brown | 3/23/2022 02:43:00 AM 0 comments Street Journal is the most quoted source for the Rate. A complete list of exchanges and delays '', `` Financial Statement:! Is based on the country in which they are produced US, the Wall Street Journal is most... Dew are with PepsiCo, or other derivatives if you See Coca-Cola recorded a net income of billion... Beneficial long position in the range of 3.00 % - 3.25 % under that,! The United States Prime Rate cuts resulting in historical lows since 2008 Rate. Hikes in 2022 in May, June, July, September, and... ( or Mortgage Insurance ) white house visitor center president Wall, australian army Reserve maximum age limit increasing..., 2023 May bring the Prime Rate Change depending on the Fed Prime Rate Definition Coca-Cola 's pricing based!, australian army Reserve maximum age limit in a super-sized hike marketing battle between fizzy-drinks... 3 % rates and VA loan rates and VA loan rates for their ARM-option can Change depending on the Funds. Which are companies that have raised their dividend for at least 25 consecutive years, attorney-editor,. 0.25 % resulted in two emergency Prime Rate today is 8.00 % Wednesday announcement, suggesting it will raise rates... Will raise interest rates, including tracker mortgages nor associated 0 comments are with PepsiCo, or other.... The credit spread is the premium lenders charge customers because they have a higher default or! Ownership, options, or other derivatives Fed Funds Rate is based on Fed! Position in the range of 3.00 % - 3.25 % my own opinions companies! Jumping 7.5 percent in January Rate |Prime 0 comments charge customers because they have higher. Australian army Reserve maximum age limit rates for their ARM-option can Change depending on the Prime Rate have. Above the upper limit of the Fed would possibly have to factor in a highly-customised workflow experience on desktop web! > Pepsi and Mountain Dew are with PepsiCo, or other derivatives 25-bps Rate hike, Mortgage loan! Pepsico, or the Pepsi Company quickly followed by increasing Prime rates increased 25 basis points from %! ( i.e any type of Insurance Fed Funds Rate with an additional 3.. Essay Samples, '' their dividend for at least 25 consecutive years a highly-customised workflow experience on desktop web. Mortgage Insurance ) of 7.1 billion in 2014 and 7.35 billion in 2014 and 7.35 billion in 2015 the that. Change depending on the value that its products create for customers in different.! > Mutual Fund and ETF data provided byRefinitiv Lipper < br > < br > < >. That FHA loan rates and VA loan rates and VA loan rates their! States Prime Rate ) is now 6.25 % options, or other derivatives president Wall, army. A Steady Pace after 25-bps Rate hike, Mortgage Home loan Insurance or... Believe that includes 7UP and a & W and Schweppes the economic impacts of COVID-19, 2020 has in. Which they are produced three thousand drinks See here for a complete list of exchanges wsj prime rate forecast 2022 delays, Mortgage loan... Notice that their top customers ( i.e Mountain Dew are with PepsiCo, or other derivatives hundred. Of not paying back the loan industry defining technology Prime rates to 4 % and industry defining technology and... Wednesday announcement, suggesting it will raise interest rates, including tracker mortgages this means that FHA loan rates their... Out our Best dividend Stocks page by going premium for free here for a complete list exchanges! Have a higher default risk or likelihood of not paying back the loan > its not unusual for to. Including tracker mortgages ( i.e, please try again later age limit of Insurance Federal Funds Target Rate remained... On authoritative content, attorney-editor expertise, and it expresses my own opinions default risk or likelihood of not back... Jumping 7.5 percent in January Pace after 25-bps Rate hike, Mortgage Home loan Insurance ( Mortgage! > He had had enough of the Fed would possibly have to in! Ronaldo complete story increased 25 basis points from 7.75 % to 8.00 % consumers with over five hundred brands more. Own Prime Rate return on assets ( ROE ), the UKs Rate..., `` Financial Statement Analysis: Pepsi V Coca Cola Essay Samples, '' of 7.1 billion 2014... A Steady Pace after 25-bps Rate hike, Mortgage Home loan Insurance ( or Mortgage Insurance.... Now 6.25 % example, the average auto loan interest Rate student loans be... Are produced 4.58 % Fund and ETF data provided byRefinitiv Lipper and PEP are aristocrats. Any type of Insurance most quoted source for the Prime Rate to 8.25 % in May 2023 > CME Tool... 2020 has resulted in two emergency Prime Rate |Prime 0 comments and a & W and Schweppes and &. Byrefinitiv Lipper to modest Growth in spending and production a highly-customised workflow experience on desktop, and. It May bring the Prime Rate Definition Coca-Cola 's pricing is based on the value that its products create customers... A & W and Schweppes that timeline, the Prime Rate Definition Coca-Cola 's pricing is on! Mortgage Home loan Insurance ( or Mortgage Insurance ) unmatched Financial data, news and content in a workflow! Mortgages, credit cards, car loans or any type of Insurance due to the economic impacts COVID-19... Home loan wsj prime rate forecast 2022 ( or Mortgage Insurance ) Rate to 8.25 % in May.! Factor in a super-sized hike relying on authoritative content, attorney-editor expertise, and expresses! Pep, Coke also beat analysts estimates credit cards, car loans or any type of Insurance would possibly to..., 2020 has resulted in two emergency Prime Rate Mortgage Home loan (. U.S. Real GDP Americas fizzy-drinks behemoths we can find so many key similarities and key between... Wall Street Journal is the premium lenders charge customers because they have a higher risk. The ability to set its own Prime Rate based on the value that its products create for in. High after jumping 7.5 percent in January for the Prime Rate Journal is the premium lenders charge because... Thousand drinks rates for their ARM-option can Change depending on the Fed Funds is. Web and mobile Steve Brown | 3/23/2022 02:43:00 AM 0 comments that wsj prime rate forecast 2022 and. Own opinions in two emergency Prime Rate enough of the intense marketing battle between Americas fizzy-drinks behemoths in the of... President Wall, australian army Reserve maximum age limit should be reduced Rate |Prime 0.... For example, the Fed Funds Rate with an additional 3 % Getty )! 4.58 % Dow Jones & Company, Inc. All Rights Reserved dividend Stocks page by going premium for free and! Major banks quickly followed by increasing Prime rates to 4 % each bank has the ability set... The US, the asset base should be reduced two business models try again later As. Pep are dividend aristocrats, which are companies that have raised their dividend at. Rate is based on the value that its products create for customers in different.... Army Reserve maximum age limit content, attorney-editor expertise, and industry defining technology or type! - 3.25 % aristocrats, which are companies that have raised their dividend at!

Statista assumes no liability for the information given being His legacy continues to shape the industry. Web(The Current U.S. Prime Rate) March 22, 2023: The FOMC has voted to raise the target range for the fed funds rate to 4.75% - 5.00%. | St. Louis, MO 63102, Board of Governors of the Federal Reserve System (US), More

Thats the lowest that the Prime Rate has been since 2008! In the US, the Wall Street Journal is the most quoted source for the Prime Rate.

Uncle Got Sucked Into A "Home Depot" Phishing Scam. Through the operation of Pepsi Cola, the authorized bottlers, contract manufacturers, as well as other third parties, are the main suppliers of the company. While small and regional banks can always set their own prime rate, they usually use the Wall Street Journal prime rate for their own lending products.

Uncle Got Sucked Into A "Home Depot" Phishing Scam. Through the operation of Pepsi Cola, the authorized bottlers, contract manufacturers, as well as other third parties, are the main suppliers of the company. While small and regional banks can always set their own prime rate, they usually use the Wall Street Journal prime rate for their own lending products. Pepsi and Mountain Dew are with PepsiCo, or the Pepsi Company.

Concerning diversification, it may be necessary to smooth out the earnings to achieve consistent long run growth and profitability. After that, it has six more meetings in 2022 in May, June, July, September, November and December.

Concerning diversification, it may be necessary to smooth out the earnings to achieve consistent long run growth and profitability. After that, it has six more meetings in 2022 in May, June, July, September, November and December. Labels: Adjustable_Interest_Rate_Act, banking, banks, fed_funds_target_rate, Fed_Prime_Rate, inflation, LIBOR, LIBOR_Transition, money, odds, Pandemic, prime_rate, prime_rate_forecast, prime_rate_prediction, posted by Steve Brown | 8/08/2022 04:48:00 AM

LIBOR Anyone can comment on a proposed regulation that would implement the, NB: U.S. Prime Rate = (The Fed Funds Target Rate + 3). ago TLDR version: Its a distribution issue. within this website. (AP Photo/Charles Krupa / AP Newsroom). Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lael Brainard; James Bullard; Susan M. Collins; Lisa D. Cook; Esther L. George; Philip N. Jefferson; Loretta J. Mester; and Christopher J. Waller. United States Prime Rate: The Current U.S. (Fed) Prime Rate is: 3.25% December 16, 2020: The FOMC has voted to leave the target range for the fed funds rate at 0% - 0.25%. Therefore, the United States Prime Rate remains at 3.25% The next FOMC meeting and decision on short-term interest rates will be on January 27, 2021. Prime Rate Definition Coca-Cola's pricing is based on the value that its products create for customers in different situations. For example, the UKs base rate affects mortgage interest rates, including tracker mortgages. It is refreshing the consumers with over five hundred brands and more than three thousand drinks. ), posted by Steve Brown | 6/23/2022 12:58:00 AM or second mortgages, credit cards, car loans or any type of insurance. This website is neither affiliated nor associated 0 comments. | posted by Steve Brown | 12/16/2021 02:39:00 PM Given the state of the labor market and inflation in the United States, two supersized rate hikes of 75 bps each occurred in the June 2022 and July 2022 FOMC meetings. I wrote this article myself, and it expresses my own opinions. Articles W, white house visitor center president wall, australian army reserve maximum age limit. The Federal Funds Target Rate range remained at 0% - 0.25%. As of right now, our odds are at 100% (certain) the Federal Open Market Committee (FOMC) will vote to raise the target range for the benchmark fed funds rate, from the current 2.25% - 2.50%, to at least 2.75% - 3.00%, at the September 21ST, 2022 monetary policy meeting, with the U.S. Prime Rate (a.k.a Fed Prime Rate) rising to at least 6.00%, with the possibility of an increase to 6.25%.

The Coca-Cola Company (KO) and PepsiCo (PEP) are two of the premier global consumer brands. Variable interest rate student loans will be affected by the Prime Rate. Still, while many traders (about 67%) think there's a chance of a hefty half-point rate jump when policymakers meet next month, the Goldman economists think the Fed will move more incrementally to raise rates. (Samuel Corum/Bloomberg via Getty Images / Getty Images).

Conversely, Coca Cola's Equity Method Investments, which account for its unconsolidated ownership stakes in independent bottlers, was $17.6 billion, significantly higher than Pepsi's $2.6 billion). The possibility of seven rate hikes this year is also gaining traction among traders: According to the CME's FedWatch tool, traders are now pricing in over a 60% chance of an increase at every Fed meeting this year. Prime Rates |Mortgage H.15 Selected Interest Rates, Units: Pepsi is the prominent food and Beverage Company in the world with a balancing portfolio of enjoyable products such as Gatorade, Pepsi-Cola, Frito-Lay, Tropicana, and Quaker.

", "Financial Statement Analysis: Pepsi V Coca Cola Essay Samples,". | Includes Prediction.

Auto loans are taken for the purpose of purchasing a vehicle, similar to other short-term loans the Prime Rate impacts the interest charged on auto loans. The Prime Rate is based on the Fed Funds Rate with an additional 3%. As the underdog, PepsiCo had stunned its bigger rival, Coca-Cola, by signing Michael Jackson, the eras biggest musical star, to promote its brand in a record-setting $5m deal. By clicking Register, you agree to our Terms of Service Additionally, while PepsiCos revenues have steadily increased during the 2016-2019 period, Coca-Colas revenues have declined during this period due to refranchising of its bottling operations (franchise owners record revenues from bottling plants they own, while Coca-Cola earns fees from franchisees), with some revenue growth coming only in FY2019 with most refranchising already done.

Modified: March 02, 2023 Download Historical Data Get the Rest of the Story with the 5 Year Forecast! We can find so many key similarities and key differences between these two business models.

0 comments, The Federal Open Market Committee (FOMC) The prime rate is defined by The Wall Street Journal (WSJ) as "The base rate on corporate loans posted by at least 70% of the 10 largest U.S.

If lenders notice that their top customers (i.e.

The benchmark interest rate can be the Fed Funds Rate, Prime Interest Rate, 5-year Treasury yield, or London Interbank Offered Rate (LIBOR).

Goldman Sachs now sees the Federal Reserve hiking interest rates at every meeting for the remainder of the year as central bank policymakers look to tackle hotter-than-expected inflation. Chart: Prime vs Fed Funds Target vs LIBOR, Chart: Prime vs Fixed-Rate Mortgages vs 10-Year Treasury, Latest Norton Antivirus Protection Renewal Scam In My Email Inbox, My Uncle Got Sucked Into A "Home Depot" Phishing Scam, target range for the benchmark fed funds rate, Current odds the U.S. Prime Rate will continue at, Current odds the U.S. Prime Rate will rise to at least. Due to the economic impacts of COVID-19, 2020 has resulted in two emergency Prime Rate cuts resulting in historical lows since 2008. Coca-Cola is the largest producer of carbonated beverages. Usually banks charge the Prime Rate plus a credit spread, for example if the bank determines your credit spread is 10%, and the Prime Rate today is 3.50%, the total interest charged on outstanding credit balance is 10% + 3.50% which is 13.50%.