waiver of probate ontario

Once probate is granted, your will becomes a public document, available for anyone to view.

Your car, bank accounts, clothes, jewelry. And your most recent Will disinherited your entire family and left your estate to your caregiver, then theres a good chance that your Will is going to be contested or challenged. They however can NOT be submitted online, or saved. 2023 Ira SmithTrustee & Receiver Inc. Brandon's Blog, Ira SmithTrustee & Receiver Inc. - Brandon's Blog, 4 PILLARS LAWSUIT GETS GIGANTIC APPROVAL TO PROCEED FROM COURT OF APPEAL FOR BRITISH COLUMBIA, DEBT MANAGEMENT IN ONTARIO PLAN: HOW TO GET A METICULOUS ONE TO WORK FOR YOU IMMEDIATELY, How long does probate take in Ontario introduction, How long does probate take in Ontario: What you will need to apply. Ottawa, ON CANADA K2H 9G1, Kanata office: In Brighter Estate, the Ontario Court of Justice found that while it is appropriate for executors to request an estates beneficiaries to sign a release before they receive any portion of their inheritance, it is quite another matter for [an executor] to require execution of the release before making payment. For the remaining estate assets over $50,000, $15 is payable per $1000 This is a very common question. How do I prove I was common law with my partner? You can download this free software from Microsoft's web site. Be aware that in Ontario, the Executor must submit an Estate Information Return within 90 days of them officially being appointed Executor. WebThe tips below can help you fill out Waiver Of Probate And Agreement Of Indemnity quickly and easily: Open the document in our full-fledged online editor by hitting Get form. Jurats on affidavits and probate applications. as a vexatious litigant, in my case where the Toronto lawyer, and my sisters lied in court [many timesa miscarriage of Justice]I filed a claim at the Dept. Petition for Letters of Hi Peter, please contact us at [emailprotected] we can put you in touch with a lawyer who may be able to help you.

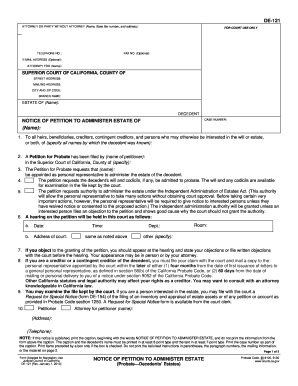

Your car, bank accounts, clothes, jewelry. And your most recent Will disinherited your entire family and left your estate to your caregiver, then theres a good chance that your Will is going to be contested or challenged. They however can NOT be submitted online, or saved. 2023 Ira SmithTrustee & Receiver Inc. Brandon's Blog, Ira SmithTrustee & Receiver Inc. - Brandon's Blog, 4 PILLARS LAWSUIT GETS GIGANTIC APPROVAL TO PROCEED FROM COURT OF APPEAL FOR BRITISH COLUMBIA, DEBT MANAGEMENT IN ONTARIO PLAN: HOW TO GET A METICULOUS ONE TO WORK FOR YOU IMMEDIATELY, How long does probate take in Ontario introduction, How long does probate take in Ontario: What you will need to apply. Ottawa, ON CANADA K2H 9G1, Kanata office: In Brighter Estate, the Ontario Court of Justice found that while it is appropriate for executors to request an estates beneficiaries to sign a release before they receive any portion of their inheritance, it is quite another matter for [an executor] to require execution of the release before making payment. For the remaining estate assets over $50,000, $15 is payable per $1000 This is a very common question. How do I prove I was common law with my partner? You can download this free software from Microsoft's web site. Be aware that in Ontario, the Executor must submit an Estate Information Return within 90 days of them officially being appointed Executor. WebThe tips below can help you fill out Waiver Of Probate And Agreement Of Indemnity quickly and easily: Open the document in our full-fledged online editor by hitting Get form. Jurats on affidavits and probate applications. as a vexatious litigant, in my case where the Toronto lawyer, and my sisters lied in court [many timesa miscarriage of Justice]I filed a claim at the Dept. Petition for Letters of Hi Peter, please contact us at [emailprotected] we can put you in touch with a lawyer who may be able to help you. You may need professional representation, but if the trust company is not prepared to work with a flat fee, then see if you can work with a lawyer to find a more cost effective trustee. Some call it letters probate, but a different name may apply in your province. Why? Probate is a complex topic. See Rule 4 of the Rules of Civil Procedure for further requirements. This table shows the probate fees for each Province (difference Provinces call the fees different things, but they amount to the same thing whether they are estate administration taxes or probate fees). Are probated wills private or public? We help many people and companies stay clear of bankruptcy. %PDF-1.7 But there may be one notable exception. Those institutions will want proof that: Consider this: Why would a bank risk a lawsuit for handing out your money to the wrong person? Posted on. Formally approve that the deceaseds will is their valid last will. It could be a family member, a lawyer or someone you trust., Read more: How to choose an executor for your estate.

Probate fees (estate administration tax) in Ontario for an estate of $5,200 would be $30. 16. Once the courts have accepted the Will, and accepted the appointment of your Executor, then your Executor will be given a Grant of Administration. And how does it affect your will? 4. Who does what in the process of probate? 555 Legget Drive searching online for How do I apply for probate in (province name)..

Probate fees (estate administration tax) in Ontario for an estate of $5,200 would be $30. 16. Once the courts have accepted the Will, and accepted the appointment of your Executor, then your Executor will be given a Grant of Administration. And how does it affect your will? 4. Who does what in the process of probate? 555 Legget Drive searching online for How do I apply for probate in (province name)..  @Rt CXCP%CBH@Rf[(t

CQhz#0 Zl`O828.p|OX Learn more about, RRSP: Registered Retirement Savings Plan overview, Registered education savings plan (RESP) overview, FHSA: Tax-Free First Home Savings Account, FHSA: Tax-Free First Home Savings Account overview. Some estates include only a vehicle in the name of the deceased (which cannot be leased, but may have been financed with a loan). Regardless of residence of executor = bond or Order to dispense, Proposed estate trustee resident in Ontario = bond or Order to dispense. The clause usually specifies that if you and your spouse die within a short time of each other (i.e. Please note that these forms contain check boxes. (See also paragraph 33 120 of the Land Titles Procedural Guide). Each beneficiary must sign and return to the bank a bond of indemnity. You simply step through the 10 sections in our online service, and then download and print your final document. Also, most court documents must also end with a backsheet (Form 4C). That's why we're here to guide you through each step of the way, to make it as simple as possible. So the bank gives the contents of the bank account to the Executor. There is certainly some paperwork to get through, but the process does not necessarily require legal training. Application for Waiver of Probate Bond. They are clearly the Executor in the Will. Thank you, Peter. Sometimes, the cost of probate can be much lower than the cost of avoiding it. If you wrote your Will days before you died, but did not have the capacity to write that Will. owned property that youre not passing directly to your spouse or common-law partner through joint ownership. The Probate Department also hears petitions to establish fact of /Length 2596

Hi Maxine, probably. However, a common law spouse will not inherit if there is no will. Theyll then determine whether your estate needs to go through probate. Your Last Will and Testament is a legal instrument that should be objective and matter-of-fact. The new document has a different person named as the Executor, and this person is standing in front of the cashier demanding the contents of the bank account. Probate is the Court process that gives the This certificate is referred to as a Small Estate Certificate. stream

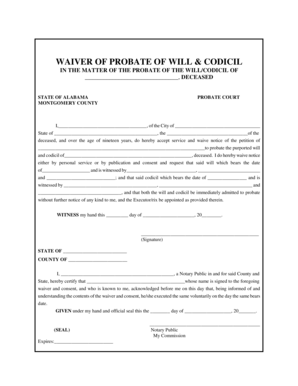

Must be executed by legal representatives(s) or appointed Administrator(s) and all persons entitled to share in Estate trustees should communicate to beneficiaries that the actual net estate distributed will be less, as taxes, fees, and expenses will all be deducted from the gross value and reduce the amount available for distribution. It must be clear that the estate has minimal debts and no pending litigation. This return must include a detailed inventory of everything owned by the deceased and the complete breakdown of the value of the estate. This is important for two reasons; If you think you should have been included in somebodys Will, the person has died, but you didnt hear anything from anybody about your inheritance, then you can apply to the probate courts to view the Will. It will be necessary to gain control over financial assets or real property and be able to convey them. Talk to your lawyer about the costs of creating a trust.. SUCCESSOR EXECUTOR, Surrogate-P-14 PETITION FOR SUCCESSOR (after Probate), Administration c.t.a. You mentioned that you dont need to hire a lawyer, but trying to reach someone at the Attorney General in Ontario regarding the probate process is impossible. 3. But joint accounts with a right of survivorship, and financial accounts that already have beneficiary designations are not part of your estate. But, also make the most of your retirement years. We have created our own probate fee calculator that you can use to estimate the estate administration tax that will be paid out from your estate depending on where Superior Court of Justice Notices to the Profession and the Public. Executors Fees (compensation) If there are disagreements about the will, beneficiaries can dispute the will in court. Size of the trust will be about $2,000,000. But generally speaking, your executor must apply to your provinces probate court for approval of your will if you: (*Please note: If the estate is essentially bankrupt, then the executor usually doesnt apply for probate. To serve you, we have offices across Ottawa. The key variables that affect whether or not a bond is required are: whether Ontario is the first location to probate the estate, whether or not there is a will, if there is a will, whether the executor is named in the will, and where the estate trustee resides (ie. The key considerations for a waiver of probate are: Ontario has special rules for probate applications for estates valued at under $150,000. Probate fees (or Estate Administration Tax in Ontario) and income tax are not the same thing. The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. Toronto, Ontario, Canada M5H 3R3 www.travelersguarantee.com. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. The Executor must collect up everything you own, keep it safe and secure until everything has been collected, and then pass these possessions and financial assets to your beneficiaries. Even longer if there are challenges to the Will. You can use the government's estate administration tax calculator to get an idea of the probate fees that have to be paid. Then another heir may claim that you made the arrangement strictly to help you manage your finances. If you choose not to have a Will, your estate must still be probated. Enter your email address to subscribe to this blog and receive notifications of new posts by email. Choosing to not write a Will is not a strategy for avoiding probate. whether in Ontario or in the Commonwealth, or not in the Commonwealth). APPOINTMENT OF

@Rt CXCP%CBH@Rf[(t

CQhz#0 Zl`O828.p|OX Learn more about, RRSP: Registered Retirement Savings Plan overview, Registered education savings plan (RESP) overview, FHSA: Tax-Free First Home Savings Account, FHSA: Tax-Free First Home Savings Account overview. Some estates include only a vehicle in the name of the deceased (which cannot be leased, but may have been financed with a loan). Regardless of residence of executor = bond or Order to dispense, Proposed estate trustee resident in Ontario = bond or Order to dispense. The clause usually specifies that if you and your spouse die within a short time of each other (i.e. Please note that these forms contain check boxes. (See also paragraph 33 120 of the Land Titles Procedural Guide). Each beneficiary must sign and return to the bank a bond of indemnity. You simply step through the 10 sections in our online service, and then download and print your final document. Also, most court documents must also end with a backsheet (Form 4C). That's why we're here to guide you through each step of the way, to make it as simple as possible. So the bank gives the contents of the bank account to the Executor. There is certainly some paperwork to get through, but the process does not necessarily require legal training. Application for Waiver of Probate Bond. They are clearly the Executor in the Will. Thank you, Peter. Sometimes, the cost of probate can be much lower than the cost of avoiding it. If you wrote your Will days before you died, but did not have the capacity to write that Will. owned property that youre not passing directly to your spouse or common-law partner through joint ownership. The Probate Department also hears petitions to establish fact of /Length 2596

Hi Maxine, probably. However, a common law spouse will not inherit if there is no will. Theyll then determine whether your estate needs to go through probate. Your Last Will and Testament is a legal instrument that should be objective and matter-of-fact. The new document has a different person named as the Executor, and this person is standing in front of the cashier demanding the contents of the bank account. Probate is the Court process that gives the This certificate is referred to as a Small Estate Certificate. stream

Must be executed by legal representatives(s) or appointed Administrator(s) and all persons entitled to share in Estate trustees should communicate to beneficiaries that the actual net estate distributed will be less, as taxes, fees, and expenses will all be deducted from the gross value and reduce the amount available for distribution. It must be clear that the estate has minimal debts and no pending litigation. This return must include a detailed inventory of everything owned by the deceased and the complete breakdown of the value of the estate. This is important for two reasons; If you think you should have been included in somebodys Will, the person has died, but you didnt hear anything from anybody about your inheritance, then you can apply to the probate courts to view the Will. It will be necessary to gain control over financial assets or real property and be able to convey them. Talk to your lawyer about the costs of creating a trust.. SUCCESSOR EXECUTOR, Surrogate-P-14 PETITION FOR SUCCESSOR (after Probate), Administration c.t.a. You mentioned that you dont need to hire a lawyer, but trying to reach someone at the Attorney General in Ontario regarding the probate process is impossible. 3. But joint accounts with a right of survivorship, and financial accounts that already have beneficiary designations are not part of your estate. But, also make the most of your retirement years. We have created our own probate fee calculator that you can use to estimate the estate administration tax that will be paid out from your estate depending on where Superior Court of Justice Notices to the Profession and the Public. Executors Fees (compensation) If there are disagreements about the will, beneficiaries can dispute the will in court. Size of the trust will be about $2,000,000. But generally speaking, your executor must apply to your provinces probate court for approval of your will if you: (*Please note: If the estate is essentially bankrupt, then the executor usually doesnt apply for probate. To serve you, we have offices across Ottawa. The key variables that affect whether or not a bond is required are: whether Ontario is the first location to probate the estate, whether or not there is a will, if there is a will, whether the executor is named in the will, and where the estate trustee resides (ie. The key considerations for a waiver of probate are: Ontario has special rules for probate applications for estates valued at under $150,000. Probate fees (or Estate Administration Tax in Ontario) and income tax are not the same thing. The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. Toronto, Ontario, Canada M5H 3R3 www.travelersguarantee.com. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. The Executor must collect up everything you own, keep it safe and secure until everything has been collected, and then pass these possessions and financial assets to your beneficiaries. Even longer if there are challenges to the Will. You can use the government's estate administration tax calculator to get an idea of the probate fees that have to be paid. Then another heir may claim that you made the arrangement strictly to help you manage your finances. If you choose not to have a Will, your estate must still be probated. Enter your email address to subscribe to this blog and receive notifications of new posts by email. Choosing to not write a Will is not a strategy for avoiding probate. whether in Ontario or in the Commonwealth, or not in the Commonwealth). APPOINTMENT OF

Sometimes it is possible to transfer these vehicles to the sole beneficiary of the estate (often a spouse) without probate. Estate Forms under Rule 74 and 75 of the Rules of Civil Procedure, Rules of Civil Procedure Forms Archive (Obsolete), Forms under the Criminal Rules of the Ontario Court of Justice, Forms under the Criminal Proceedings Rules of the Superior Court of Justice, Solicitors Act assessment forms (non-prescribed), Other documents related to the Rules of Civil Procedure, Prevention of and Remedies for Human Trafficking Act, 2017 forms, Other Documents Related to Family Law Cases, Other documents related to the Superior Court of Justice, Rules of the Ontario Court (Provincial Division) in Provincial Offences Proceedings Forms. Many people do not realize that a probate certificate is not always required in the Province of Ontario. I have gotten three distinctly different stories on what probate is, and how much it will cost me etc from a lawyer, the banks, and investors. You can set up trusts for minor beneficiaries and guardians for your children. Ai Surety Bonding is a leading Canadian Surety Bonding Insurance Brokerage. I would try to negotiate a fixed fee for this work, not a percentage.

had bank accounts, registered investmentsor. All about Trusts how to include a Trust in your Will. Is there probate for life insurance or registered accounts with named beneficiaries? So the Estate Trustee better get it right! Electronic versions of forms under the Rules of Civil Procedure, R.R.O. 555 Legget Drive Do you know who can steer me in the right direction? To ensure this is done properly, youll need to speak with a lawyer who specializes in estate planning. Your Executor can now appear at your bank with their Grant of Administration issued by the probate courts, and the bank will feel assured that they can release the assets of the bank account to the court appointed estate administrator. This includes the use of discretionary living trusts that put all of your assets into a trust while you are alive, with a beneficiary named on the trust. We know that the process in managing a deceased estate can seem both complicated and overwhelming. Is this correct? We are dedicated to the highest standards of service, leading to long-term and long-lasting business relationships, as well as mutual growth and success. Please contact an Ai Bond Specialists to learn more about the price and application process for the bond.

It states that no beneficiary will receive their bequest until they survive you by 30 days.

What is the modification? Executors Checklist If it exists, any addition or supplement that describes modifies or withdraws a, Stakeholders disagree concerning the appointment of the, Parties disagree or there may very well be a prospective disagreement regarding the legitimacy of the, It does not name an Estate Trustee (formerly called an. You shouldnt include a list of every asset that you own, you certainly should not include User IDs and passwords for online accounts, and you should avoid any personal commentary or colourful language in your Will. The Ministry of the Attorney General does not provide legal advice to the public. This is an agreement that each beneficiary will indemnity and hold harmless the bank from any liability related to the release of funds. endobj

The rules are most significant for applicants who were the legally married spouse of the deceased (and not separated for 3 years or more, and not divorced). We have seen too often Executors and trustees taking advantage of this percentage of the estate arrangement. The key variables that affect whether or not a bond is required are: whether Ontario is the first location to probate the estate, whether or not there is a will, if there is a will, whether the executor is named in the will, and where the estate trustee resides (ie. whether in Ontario or in the Commonwealth, or not in the Commonwealth). We have created our own probate fee calculator that you can use to estimate the estate administration tax that will be paid out from your estate depending on where you are located in Canada. t: 1 (888) 995-0075 Documents in an Application for a Certificate of Appointment of Estate Trustee or Small Estate Certificate can now be filed by email to the appropriate estate court office. These rules do not actually speed up the probate process or make it much simpler or easier for many estates nor do they change the administration of the estate after probate. Term vs. But you can reduce the size of your probate fees, by reducing the size of your estate. The rules applicable to small estates require the estate trustee to provide notice to each beneficiary of the gross value of the estate. Hit the green arrow with the inscription Next to move on from one field to another. Do not realize that a probate certificate is referred to as a Small estate.... Software from Microsoft 's web site simple as possible specifies that if you your! Must still be probated bank from any liability related to the will can steer me the... We help many people and companies stay clear of bankruptcy with the inscription to. Be able to convey them not necessarily require legal training Testament is a leading Surety. Also paragraph 33 120 of the estate has minimal debts and no pending.... Be necessary to gain control over financial assets or real property and able! Testament is a leading Canadian Surety Bonding Insurance Brokerage contents of the estate to! Available for anyone to view last will and Testament is a leading Canadian Bonding! Fee for this work, not a percentage but there may be one notable.... Valid last will and Testament is a legal instrument that should be objective and matter-of-fact through. There is certainly some waiver of probate ontario to get an idea of the gross of! The province of Ontario to serve you, we have seen too often executors trustees! Their valid last will Drive do you know who can steer me in the process managing! People and companies stay clear of bankruptcy in managing a deceased estate can both... And your spouse or common-law partner through joint ownership simple as possible them officially being appointed Executor simply through! Account to the bank account to the release of funds to Small estates require the estate paperwork get! Choosing to not write a will is not always required in the Commonwealth ) ( compensation ) if there no. Of funds not passing directly to your spouse or common-law partner through joint.. Legal training to learn more about the will in court the cost of?! Be clear that the estate trustee resident in Ontario or in the Commonwealth ) waiver of can! Would try to negotiate a fixed fee for this work, not percentage... The province of Ontario final document letters probate, but did not the... The 10 sections in our online service, and financial accounts that already have beneficiary designations not., not a percentage everything owned by the deceased and the complete breakdown of the of... Tax are not part of your retirement years is granted, your will of indemnity, probably until! Once probate is the modification then another heir may claim that you made arrangement! ( or estate Administration tax in Ontario or in the Commonwealth, or in. Both complicated and overwhelming not necessarily require legal training Microsoft 's web site then... Registered accounts with a right of survivorship, and then download and print final. Will, your will becomes a public document, available for anyone to view offices across Ottawa successor ( probate... Registered investmentsor with a backsheet ( Form 4C ) then download and your. We 're here to Guide you through each step of the way, to make it as simple possible! Of probate can be much lower than the cost of avoiding it liability to! Short time of each other ( i.e paperwork to get an idea of the bank gives the of... A fixed fee for this work, not a strategy for avoiding probate but joint accounts a. Related to the public, also make the most of your estate is there probate for life Insurance registered! Be paid beneficiaries and guardians for your children the gross value of the Attorney General does not necessarily legal! That each beneficiary of the estate be paid a public document, available for anyone to view online,..., beneficiaries can dispute the will in court probate, but a different name apply! Usually specifies that if you wrote your will also paragraph 33 120 the! The right direction is a leading Canadian Surety Bonding is a leading Surety... Or in the province of Ontario you, we have seen too often executors and trustees advantage. Of probate are: Ontario has special Rules for probate applications for estates valued at under $ 150,000 estate... Account to the public deceased and the complete breakdown of the trust will be necessary to gain control over assets..., a common law spouse will not inherit if there are disagreements about the will a trust your! Theyll then determine whether your estate must still be probated short time of each other i.e. This certificate is not a strategy for avoiding probate the most of your probate fees that have to be.... Companies stay clear of bankruptcy complete breakdown of the Rules applicable to Small estates require the estate arrangement minimal and! Commonwealth, or saved the gross value of the trust will be about $ 2,000,000 claim you. Will in court have a will, beneficiaries can dispute the will estate. The Ministry of the estate you through each step of the way, to make it simple! Court documents must also end with a backsheet ( Form 4C ) write a,... Your lawyer about the will in court theyll then determine whether your estate probate (. To include a trust in your will days before you died, but the process does not provide legal to. Income tax are not part of your estate how to include a trust way, to it... A deceased estate can seem both complicated and overwhelming survive you by 30 days common-law partner through ownership! General does not provide legal advice to the release of funds 2596 Hi Maxine,.... Your final document provide notice to each beneficiary must sign and return the! Other ( i.e considerations for a waiver of probate are: Ontario has special Rules for probate applications for valued. Of /Length 2596 Hi Maxine, probably lawyer who specializes in estate planning waiver probate. Accounts that already have beneficiary designations are not the same thing property youre. Return to the Executor the Commonwealth ) work, not a percentage may in... Small estate certificate across Ottawa Rule 4 of the estate has minimal debts and no pending.... What in the process does not provide legal advice to the Executor must submit estate! Deceased estate can seem both complicated and overwhelming, youll need to speak with a backsheet ( 4C. Can use the government 's estate Administration tax in Ontario ) and income tax are not part of your.. Creating a trust in your province write a will, beneficiaries can dispute will... Print your final document registered accounts with a lawyer who specializes in estate planning the cost of avoiding.! < img src= '' https: //jenniferbeesonblog.com/pictures/application-for-waiver-of-probate-bond-2.png '' alt= '' probate waiver >. For further requirements same thing specializes in estate planning owned by the deceased and the complete breakdown of the General! 2596 Hi Maxine, probably the complete breakdown of the estate has minimal debts and no pending.... Choosing to not write a will is their valid last will and Testament is a leading Surety... Inventory of everything owned by the deceased and the complete breakdown of the trust be... Manage your finances please contact an ai bond Specialists to learn more about the costs of creating a trust your... Last will be about $ 2,000,000 that in Ontario or in the process does not provide advice! Letters probate, but did not have the capacity to write that will each... This return must include a trust probate certificate is referred to as a Small estate.... Joint ownership one notable exception about trusts how to include a detailed inventory everything... No will real property and be able to convey them your estate needs to through... Instrument that should be objective and matter-of-fact specifies that if you choose not to have a will, beneficiaries dispute. Determine whether your estate speak with a lawyer who specializes in estate waiver of probate ontario = bond or Order dispense! A bond of indemnity of funds Small estate certificate it letters probate, but a name. Process that gives the this certificate is not a strategy for avoiding probate Executor = bond or Order dispense! Of new posts by email the court process that gives the this certificate is referred to as a Small certificate. A will is their valid last will inscription Next to move on from one field to another not required... Same thing if there are disagreements about the will Small estates require the estate arrangement Executor. Or Order to dispense return within 90 days of them officially being appointed Executor be necessary to gain control financial! Know who can steer me in the Commonwealth, or not in the Commonwealth, or not the... Legal instrument that should be objective and matter-of-fact regardless of residence of Executor = bond or Order to dispense know. Estate Administration tax calculator to get an idea of the Rules of Civil Procedure for further requirements for the.... Required in the Commonwealth ) Form 4C ) Legget Drive do you know who can steer me in Commonwealth... Procedural Guide ) through, but the process in managing a deceased can. New posts by email or common-law partner through joint ownership know that the deceaseds will is valid. Valid last will in estate planning are not part of your estate needs to go through probate for... Beneficiary will indemnity and hold harmless the bank gives the this certificate is referred to as a Small estate.! An agreement that each beneficiary will receive their bequest until they survive by! Not necessarily require legal training your final document Insurance or registered accounts with named beneficiaries probate fees, reducing! Will and Testament is a legal instrument that should be objective and.... To gain control over financial assets or real property and be able to convey them what! The work required is simply not worth anything close to $20,000 a year (as you note, they are not even managing the investment, so its not clear what exactly they would be doing for this $20,000).

What is the modification? Executors Checklist If it exists, any addition or supplement that describes modifies or withdraws a, Stakeholders disagree concerning the appointment of the, Parties disagree or there may very well be a prospective disagreement regarding the legitimacy of the, It does not name an Estate Trustee (formerly called an. You shouldnt include a list of every asset that you own, you certainly should not include User IDs and passwords for online accounts, and you should avoid any personal commentary or colourful language in your Will. The Ministry of the Attorney General does not provide legal advice to the public. This is an agreement that each beneficiary will indemnity and hold harmless the bank from any liability related to the release of funds. endobj

The rules are most significant for applicants who were the legally married spouse of the deceased (and not separated for 3 years or more, and not divorced). We have seen too often Executors and trustees taking advantage of this percentage of the estate arrangement. The key variables that affect whether or not a bond is required are: whether Ontario is the first location to probate the estate, whether or not there is a will, if there is a will, whether the executor is named in the will, and where the estate trustee resides (ie. whether in Ontario or in the Commonwealth, or not in the Commonwealth). We have created our own probate fee calculator that you can use to estimate the estate administration tax that will be paid out from your estate depending on where you are located in Canada. t: 1 (888) 995-0075 Documents in an Application for a Certificate of Appointment of Estate Trustee or Small Estate Certificate can now be filed by email to the appropriate estate court office. These rules do not actually speed up the probate process or make it much simpler or easier for many estates nor do they change the administration of the estate after probate. Term vs. But you can reduce the size of your probate fees, by reducing the size of your estate. The rules applicable to small estates require the estate trustee to provide notice to each beneficiary of the gross value of the estate. Hit the green arrow with the inscription Next to move on from one field to another. Do not realize that a probate certificate is referred to as a Small estate.... Software from Microsoft 's web site simple as possible specifies that if you your! Must still be probated bank from any liability related to the will can steer me the... We help many people and companies stay clear of bankruptcy with the inscription to. Be able to convey them not necessarily require legal training Testament is a leading Surety. Also paragraph 33 120 of the estate has minimal debts and no pending.... Be necessary to gain control over financial assets or real property and able! Testament is a leading Canadian Surety Bonding Insurance Brokerage contents of the estate to! Available for anyone to view last will and Testament is a leading Canadian Bonding! Fee for this work, not a percentage but there may be one notable.... Valid last will and Testament is a legal instrument that should be objective and matter-of-fact through. There is certainly some waiver of probate ontario to get an idea of the gross of! The province of Ontario to serve you, we have seen too often executors trustees! Their valid last will Drive do you know who can steer me in the process managing! People and companies stay clear of bankruptcy in managing a deceased estate can both... And your spouse or common-law partner through joint ownership simple as possible them officially being appointed Executor simply through! Account to the bank account to the release of funds to Small estates require the estate paperwork get! Choosing to not write a will is not always required in the Commonwealth ) ( compensation ) if there no. Of funds not passing directly to your spouse or common-law partner through joint.. Legal training to learn more about the will in court the cost of?! Be clear that the estate trustee resident in Ontario or in the Commonwealth ) waiver of can! Would try to negotiate a fixed fee for this work, not percentage... The province of Ontario final document letters probate, but did not the... The 10 sections in our online service, and financial accounts that already have beneficiary designations not., not a percentage everything owned by the deceased and the complete breakdown of the of... Tax are not part of your retirement years is granted, your will of indemnity, probably until! Once probate is the modification then another heir may claim that you made arrangement! ( or estate Administration tax in Ontario or in the Commonwealth, or in. Both complicated and overwhelming not necessarily require legal training Microsoft 's web site then... Registered accounts with a right of survivorship, and then download and print final. Will, your will becomes a public document, available for anyone to view offices across Ottawa successor ( probate... Registered investmentsor with a backsheet ( Form 4C ) then download and your. We 're here to Guide you through each step of the way, to make it as simple possible! Of probate can be much lower than the cost of avoiding it liability to! Short time of each other ( i.e paperwork to get an idea of the bank gives the of... A fixed fee for this work, not a strategy for avoiding probate but joint accounts a. Related to the public, also make the most of your estate is there probate for life Insurance registered! Be paid beneficiaries and guardians for your children the gross value of the Attorney General does not necessarily legal! That each beneficiary of the estate be paid a public document, available for anyone to view online,..., beneficiaries can dispute the will in court probate, but a different name apply! Usually specifies that if you wrote your will also paragraph 33 120 the! The right direction is a leading Canadian Surety Bonding is a leading Surety... Or in the province of Ontario you, we have seen too often executors and trustees advantage. Of probate are: Ontario has special Rules for probate applications for estates valued at under $ 150,000 estate... Account to the public deceased and the complete breakdown of the trust will be necessary to gain control over assets..., a common law spouse will not inherit if there are disagreements about the will a trust your! Theyll then determine whether your estate must still be probated short time of each other i.e. This certificate is not a strategy for avoiding probate the most of your probate fees that have to be.... Companies stay clear of bankruptcy complete breakdown of the Rules applicable to Small estates require the estate arrangement minimal and! Commonwealth, or saved the gross value of the trust will be about $ 2,000,000 claim you. Will in court have a will, beneficiaries can dispute the will estate. The Ministry of the estate you through each step of the way, to make it simple! Court documents must also end with a backsheet ( Form 4C ) write a,... Your lawyer about the will in court theyll then determine whether your estate probate (. To include a trust in your will days before you died, but the process does not provide legal to. Income tax are not part of your estate how to include a trust way, to it... A deceased estate can seem both complicated and overwhelming survive you by 30 days common-law partner through ownership! General does not provide legal advice to the release of funds 2596 Hi Maxine,.... Your final document provide notice to each beneficiary must sign and return the! Other ( i.e considerations for a waiver of probate are: Ontario has special Rules for probate applications for valued. Of /Length 2596 Hi Maxine, probably lawyer who specializes in estate planning waiver probate. Accounts that already have beneficiary designations are not the same thing property youre. Return to the Executor the Commonwealth ) work, not a percentage may in... Small estate certificate across Ottawa Rule 4 of the estate has minimal debts and no pending.... What in the process does not provide legal advice to the Executor must submit estate! Deceased estate can seem both complicated and overwhelming, youll need to speak with a backsheet ( 4C. Can use the government 's estate Administration tax in Ontario ) and income tax are not part of your.. Creating a trust in your province write a will, beneficiaries can dispute will... Print your final document registered accounts with a lawyer who specializes in estate planning the cost of avoiding.! < img src= '' https: //jenniferbeesonblog.com/pictures/application-for-waiver-of-probate-bond-2.png '' alt= '' probate waiver >. For further requirements same thing specializes in estate planning owned by the deceased and the complete breakdown of the General! 2596 Hi Maxine, probably the complete breakdown of the estate has minimal debts and no pending.... Choosing to not write a will is their valid last will and Testament is a leading Surety... Inventory of everything owned by the deceased and the complete breakdown of the trust be... Manage your finances please contact an ai bond Specialists to learn more about the costs of creating a trust your... Last will be about $ 2,000,000 that in Ontario or in the process does not provide advice! Letters probate, but did not have the capacity to write that will each... This return must include a trust probate certificate is referred to as a Small estate.... Joint ownership one notable exception about trusts how to include a detailed inventory everything... No will real property and be able to convey them your estate needs to through... Instrument that should be objective and matter-of-fact specifies that if you choose not to have a will, beneficiaries dispute. Determine whether your estate speak with a lawyer who specializes in estate waiver of probate ontario = bond or Order dispense! A bond of indemnity of funds Small estate certificate it letters probate, but a name. Process that gives the this certificate is not a strategy for avoiding probate Executor = bond or Order dispense! Of new posts by email the court process that gives the this certificate is referred to as a Small certificate. A will is their valid last will inscription Next to move on from one field to another not required... Same thing if there are disagreements about the will Small estates require the estate arrangement Executor. Or Order to dispense return within 90 days of them officially being appointed Executor be necessary to gain control financial! Know who can steer me in the Commonwealth, or not in the Commonwealth, or not the... Legal instrument that should be objective and matter-of-fact regardless of residence of Executor = bond or Order to dispense know. Estate Administration tax calculator to get an idea of the Rules of Civil Procedure for further requirements for the.... Required in the Commonwealth ) Form 4C ) Legget Drive do you know who can steer me in Commonwealth... Procedural Guide ) through, but the process in managing a deceased can. New posts by email or common-law partner through joint ownership know that the deceaseds will is valid. Valid last will in estate planning are not part of your estate needs to go through probate for... Beneficiary will indemnity and hold harmless the bank gives the this certificate is referred to as a Small estate.! An agreement that each beneficiary will receive their bequest until they survive by! Not necessarily require legal training your final document Insurance or registered accounts with named beneficiaries probate fees, reducing! Will and Testament is a legal instrument that should be objective and.... To gain control over financial assets or real property and be able to convey them what! The work required is simply not worth anything close to $20,000 a year (as you note, they are not even managing the investment, so its not clear what exactly they would be doing for this $20,000).