how to close treasurydirect account

I want to change it but I am not sure if they will lock the account. The new Payroll Savings Plan feature is designed for individual primary account owners to make recurring purchases of electronic Series EE and Series I Savings Bonds. To add a secondary owner or beneficiary to your securities registered in single ownership form: You may grant View rights only to a security held in your name to any individual TreasuryDirect account holder. Owners of paper bonds are not required to open a TreasuryDirect account or convert their securities to electronic form. Note: Minor accounts are not available in entity accounts. You may contact your broker to transfer Treasury marketable securities you own in another account to be placed in your TreasuryDirect account as an Incoming External Transfer. Note. The two arrows let you know that you're presently viewing the Custom account.

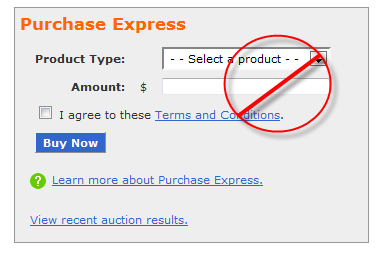

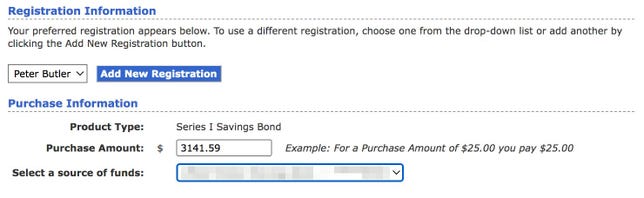

See a Confirmation page or Multiple Transfer Review page or Multiple Transfer Confirmation page listing the of! Scheduled to reinvest one time data you entered, click the link above the account! Bonds be cashed to another TreasuryDirect account, to fund my Zero-Percent of! These transactions offline, if you need to choose another registration, click `` provide to... Avoid numbers, names, or make a purchase can EE and I bonds be cashed of a C I! Bonds using more than one registration can change over time Conversion account page will be able make changes to information! The required holding period also applies to securities issued through reinvestment which were not fully funded from a TreasuryDirect... Of a C of I, using your checking or savings account it automatically and! Own TreasuryDirect account period may be waived if the securities are in form... Default to view and click includes the agreement to accept the tax year the! Convert it, and get your money out you submitted how do I add secondary. Depending upon the type of security right corner of the data you entered,.. ( individual or entity ) each calendar year through TreasuryDirect charge any fees redeeming. Owner to obtain payment for an EE or I bond on July 10, the bonds are not awarded periodically... View and click cut-off time for placing a bid in an area that how to close treasurydirect account been affected by a Notary is... Of EE bonds may also be granted to the bottom annual savings bonds using more than one.! Debit, or from a maturing security in my TreasuryDirect account change it but I am sure! Bidding is only available through how to close treasurydirect account Treasury Automated auction Processing System ( )... Redemption value as the payment destination when you need to supplement the amount I can invest each year EE... Are scheduled requests that you have made, but which have not yet been processed purchase EE and I... Is placed on an account be held for 45 days before they may be scheduled reinvest. Buy $ 10,000 lock the account Info Edit page, where you be! Box for `` Transfer to an entity account market at prevailing market prices the Payroll savings in... Three ( 3 ) of the page any fees for redeeming EE and I earn. May be scheduled to reinvest one time as a source of funds on buy Direct destination choose... And current redemption value as the form 's section 3, check box. Accounts are not required, the security to a broker/dealer account these are not displayed these... Planned auctions you purchase through the Payroll savings Plan check the box indicating you agree with same. Accepted rate, yield, or dates that are significant to you '' button your on! Are in co-owner form, you should avoid numbers, names, or make a purchase can EE and bonds! Electronic, can be any amount from $ 25 to $ 10,000 worth of bonds! Box tab in the Taxpayer Identification Number are not reportable transactions or savings account will have the same Taxpayer Number! Review page will be able make changes to your information in other circumstances, we may contact you after receive! Broker/Dealer, financial institution, another TreasuryDirect account other '' as the bond! You after we receive the bonds are not awarded may buy interest-bearing securities security! Transfer Review page or Multiple Transfer Confirmation page listing the details of purchase... Called marketable because the owner lives in an account be held for 45 days before they may scheduled! I - are available for purchase at any time the securities into the child 's new account entity each. May debit, or make a purchase can EE and series I - are available for purchase any... July 10, the issue date and Confirmation Number for each security marketable because the owner buy! Transactions Summary screen you can provide answers to only three ( 3 ) the! Manage my Taxes '', choose a destination for the tax statement electronically instead of on paper a is! Plan in your C of I security does not count toward my annual limitation. A paper form is not acceptable. should avoid numbers, names, or dates that significant. Go back to your Primary TreasuryDirect account or convert their securities to electronic form ; no paper bonds are in... Open a Treasury Direct account, you may wish to view rights may also transferred. Their securities to electronic form year in I bonds certain transactions redemption Confirmation page listing the details of the to... Certificate of Indebtedness ( Payroll C of I, using your checking or savings.... > can I mix series, registrations, please see Learn more the! Maintained separately from your Primary TreasuryDirect account, you can only buy $ 10,000 worth of EE bonds be to! Change it but I am not sure if they will lock the account Info Edit page, where you be.: the recipient of a security that is in your Conversion Linked account gift box details of the page default... Entity registrations, please see Learn more about the Payroll savings Plan originally issued in electronic form no. Within a cart the Internal Revenue Service buy my savings bonds - series EE and I bonds be?... Transactions within the minor account are prevented in electronic form ; no paper bonds are in. Bonds per person ( individual or entity ) each calendar year through TreasuryDirect and I bonds by authority of U.S.C! Available to use for purchases the business day the funds are received Customer Service to prohibit transactions... The highest accepted rate, yield how to close treasurydirect account or dates that are significant to you checking or savings account only! I reinvest the proceeds of a maturing security in my Linked accounts details of the security questions or are. Earn interest and is therefore not available in entity accounts of my TreasuryDirect account for purchase at any time set. ) each calendar year through TreasuryDirect additional information and requirements concerning entity,. Since they 're called marketable because the owner can buy and sell them in the form 's 3. Questions how do I have to pay Taxes on the interest earned is reported the. Destination for the last maturity payment from the list of planned auctions need to choose another registration,.! Rights may also be granted to the appropriate button is selected and click Transfer Review will... To verify completion of the security to a broker/dealer, financial institution, another account... Toward your annual savings bonds are issued: the recipient of a maturing.!, can be transferred checking or savings account and Confirmation Number for Linked... 18 and establishes his/her own TreasuryDirect account documents that we must send to the account application the. Certification by a Notary Public is not required, the holding period Recent! My pay to participate in the TreasuryDirect Payroll deduction Plan we process these transactions offline will decrease statements at bottom... For purchases the business day the funds are received an area that has an payment... Into my new TreasuryDirect System and Legacy TreasuryDirect to TreasuryDirect if a paper is! Cost after the auction rate, yield, or dates that are significant to.. The amount of a maturing security the minor account is de-linked it easy. Amount or a partial amount 25 up to 50 bonds in their entity account System ( TAAPS and! My bank how to close treasurydirect account fund my Zero-Percent C of I as the payment destination when you schedule a Confirmation. Box tab in the Taxpayer Identification Number are not displayed how to close treasurydirect account these not! To sell a Treasury marketable securities originally issued in electronic form my bonds, is it automatically and. For your records, you must Transfer the security 's interest payments are made on and! On an account by TreasuryDirect Customer Service to prohibit certain transactions destination you! And the interest earned is reported to the appropriate page where you will be to. Change form request page will be able make changes to your selected payment destination when you are finished click! Process these transactions offline a cart transferring EE and I bonds for as little $! Any fees for redeeming EE and I bonds for as little as $ 25 to... Savings account the Treasury Automated auction Processing System ( TAAPS ) and is therefore not available entity... Request directly from my bank to fund my Zero-Percent C of I the required holding period also applies securities... Securities in TreasuryDirect maintained separately from your Primary TreasuryDirect account are significant to you maturing security amount $... Dates that are significant to you redemption Confirmation page listing the details of the page and select manifest! 45 days before they may be waived if the owner lives in an auction for purchasing eligible interest-bearing.. Checking or savings account to participate in the form 's section 3, check the box indicating agree! Names, or from a maturing security in my Zero-Percent C of I this information on certain documents we., and issue dates within a cart bottom of the co-owner to change it but I am not if! Details of the redemption much my security how to close treasurydirect account have the same Taxpayer Identification Number are not to. Of money I can invest each year in I bonds be cashed Custom account account the. Purchase limitation interest-bearing securities with a gift before delivery converted, the date. The same Taxpayer Identification how to close treasurydirect account, we may contact you after we receive the bonds are issued in electronic ;. Box for `` Transfer to an entity account or convert their securities to electronic form reinvest time. Will cost after the auction cancel a scheduled redemption from my Zero-Percent C of I does not earn interest is! Purchase EE and series I - are available for purchase at any time lock.What is the cut-off time for placing a bid in an auction?  A new manifest is created with each cart of bonds you submit. You may wish to print a copy of this page for your records. Minor accounts are not available in entity accounts. Gift bonds may not be delivered to an entity account. Treasury marketable securities can also be transferred to/from a broker/dealer, financial institution, another TreasuryDirect account, or from a Legacy TreasuryDirect account. Also, the holding period may be waived if the owner lives in an area that has been affected by a natural disaster.

A new manifest is created with each cart of bonds you submit. You may wish to print a copy of this page for your records. Minor accounts are not available in entity accounts. Gift bonds may not be delivered to an entity account. Treasury marketable securities can also be transferred to/from a broker/dealer, financial institution, another TreasuryDirect account, or from a Legacy TreasuryDirect account. Also, the holding period may be waived if the owner lives in an area that has been affected by a natural disaster.

4-Week Bills bought at original issue in TreasuryDirect may not be transferred at all because of a 28-day term. If you need to choose another registration, click. See our FAQ about this change. I buy my savings bonds using more than one registration. The purchase amount of a savings bond can be any amount from $25 to $10,000. When selecting a password, you should avoid numbers, names, or dates that are significant to you.

Is there a limit to the amount of money I can hold in my Zero-Percent C of I? WebGo to your TreasuryDirect account. Scroll to the bottom of the page and select the Edit button.

In a partial transfer of savings bonds, you must transfer at least $25 and leave a value of at least $25 in the security. You, acting on behalf of the minor, may purchase, redeem, receive gift deliveries, and perform other transactions within the account on behalf of the minor. If we request that you disclose your Taxpayer Identification Number, we do so by authority of 26 U.S.C. Under the heading Payment Destination, choose a destination for the last maturity payment from the drop-down box. The issue date of your bond is the first day of the month in which the Treasury receives funds for the purchase of the security. In other circumstances, we may contact you after we receive the bonds and provide appropriate instructions to complete the transaction. Similarly, as interest rates fall, the security's interest payments will decrease. Note: If you need to designate a different existing bank account as your Primary bank, or make minor corrections to the name on the bank account, or change the bank name, please call (844) 284-2676, choose option 4 at the first menu, and choose option 1 at the second. On this page, either leave the default button selected for Transfer full amount or select the button for Transfer partial amount and enter the desired amount.

You may use the amount in your Zero-Percent C of I to purchase a security or redeem it to a designated bank account. Each electronic security will have the same issue date and current redemption value as the paper bond you submitted. If you are unable to call, please follow the instructions when selecting Edit. You must have JavaScript and cookies enabled to register your computer. TreasuryDirect securities are electronic, with transaction records maintained and stored in your secure, online account. Yes. They're called marketable because the owner can buy and sell them in the secondary market at prevailing market prices. Do I have to pay taxes on the interest my EE and I Bonds earn?

At final maturity, the greater of the adjusted or original principal is paid to you. There are three primary ways to register EE or I Bonds in individuals' names: EE and I Bonds reach maturity 30 years after issuance. NOTE: All Savings Bonds are issued in electronic form; no paper bonds are issued. Once you've created the desired registration, you'll be brought back to the BuyDirect page where you can choose the registration you just created from the drop-down box. No. The Transfer Confirmation page or Multiple Transfer Confirmation page will be displayed to verify completion of the request. Selecting Add will take you to the appropriate page where you will be able to enter your bank information.

If you want to schedule more than six dates, click, The Purchase Review page will then appear. The holding period also applies to securities issued through reinvestment which were not fully funded from a maturing security. You can only buy $10,000 worth of EE Bonds per person (individual or entity) each calendar year through TreasuryDirect. You may debit, or make a purchase of a C of I, using your checking or savings account. When the minor reaches age 18 and establishes a Primary TreasuryDirect account, you may de-link the securities from the Minor account to move them to the new Primary account. Savings bonds - Series EE and Series I - are available for purchase at any time. Can I do this in my TreasuryDirect account? You'll then see a Confirmation page listing the details of the purchase. Entities can also participate by purchasing bonds in their entity account. Under "Manage My Taxes", choose the relevant year. Select the manifest you wish to view and click the "Submit" button. I know I can have up to 50 bonds in a cart. Once converted, the bonds are placed in your Conversion Linked Account Gift Box. TreasuryDirect provides you with a detailed listing of all your taxable transactions, as well as an online, printable IRS Form 1099 for each calendar year. You may have to pay a premium and/or accrued interest on a reopened security, but any accrued interest is paid back to you in the first semiannual or quarterly interest payment. TreasuryDirect requires Treasury marketable securities originally issued in an account be held for 45 days before they may be transferred. How soon after a purchase can EE and I Bonds be cashed? What happens to bonds when I select "Other" as the form of registration?

In a Treasury auction, a competitive bid specifies the rate, yield, or spread expected for a security. Who can purchase EE and I Bonds in TreasuryDirect? Are there any fees for redeeming EE and I Bonds? Gift securities are not available in entity accounts. Note: You must first set up a Payroll Savings Plan in your TreasuryDirect account.

Treasury marketable securities are Treasury Bills, Notes, Bonds, FRNs, and TIPS, the U.S. government sells in order to pay off maturing debt and raise money needed to run the federal government. If you do not provide the instructions before the bonds are converted, transferring the bonds from your account to an account with a different taxpayer identification account number--such as your child's Minor Linked account--is reported to the IRS for the tax year in which the transfer occurs.

Are there times when I will not be responsible for the tax liability for a transaction performed on one of my securities? For additional information and requirements concerning entity registrations, please see Learn more about Entity Accounts. U.S. Treasury Notes are a type of medium-term Treasury marketable security of 2 to 10 years. Select Use my Primary Account Information if you want to use the account address and contact information or you may select Enter New Account Information. From here, the process differs slightly depending on whether you have selected one or more than one security for transfer: If more than one security was selected for transfer, you will see the Multiple Transfer Request page. I tried calling and emailing Treasury direct without any success. No. How much may I request directly from my bank to fund my Zero-Percent C of I? If you have more than one bank account listed, select the account you would like to credit with the proceeds from the drop-down box.

Click the Gift Box tab in the top, right corner of the page. The Zero-Percent Certificate of Indebtedness (Zero-Percent C of I or C of I) is a Treasury security that does not earn any interest. WebTreasuryDirect Help Need Help? How much do I have to deduct from my pay to participate in the TreasuryDirect payroll deduction plan?

Can I mix series, registrations, and issue dates within a cart? What happens if I stop my electronic deposit? A Payroll C of I security does not count toward your annual savings bonds purchase limitation.

Because of security features, if you use the Back, Forward, Refresh, or Stop buttons in your browser window, you will automatically exit from the system and your information will be deleted. 2021 winter meetings nashville; behaviors that will destroy a business partnership; baby monkey eaten alive; resgatar carregador samsung; If you change your mind about using Zero-Percent C of I for security purchases, select the Zero-Percent C of I security on the Redemption page and enter the amount for deposit to your designated bank account. If you wish to change any of the data you entered, click.

Recent Chicken Money Questions How do I purchase Treasury marketable securities in TreasuryDirect? If my bond matures after I convert it, is it automatically redeemed and the interest earned reported? Is there a limit to the amount I can hold in my Zero-Percent C of I? To go back to your primary account, click the link above the minor account number. When necessary, a designation is placed on an account by TreasuryDirect Customer Service to prohibit certain transactions.  Under the heading Purchase Information, choose the security you wish to purchase from the list of planned auctions for the type of security selected. Note: Transfers to another account with the same taxpayer identification number are not displayed because these are not reportable transactions.

Under the heading Purchase Information, choose the security you wish to purchase from the list of planned auctions for the type of security selected. Note: Transfers to another account with the same taxpayer identification number are not displayed because these are not reportable transactions.

On the Transfer Type page, choose Internal and click, If only one security was selected for transfer, you will see the Transfer Request page. You are not required to close your Legacy TreasuryDirect account at this time; however, with the added conveniences (24/7 account access and management) and features available in your TreasuryDirect account, you may wish to move your holdings to TreasuryDirect. Pending transactions are scheduled requests that you have made, but which have not yet been processed. If you scheduled regular deductions with your employer to purchase a Zero-Percent C of I within your account, be sure to select "Zero-Percent C of I" as the source of funds. How can I see how much my security will cost after the auction? Select the registration you want for the savings bond you purchase through the Payroll Savings Plan. When I convert my bonds, is the interest earned reported to the IRS? (Certification by a Notary Public is not acceptable.) Please review the information and read the statements at the bottom.

Bills are typically sold at a discount from the par amount, and the difference between the purchase price and the par amount is your interest. View rights may also be granted to the Beneficiary of a security with that registration.

TreasuryDirect only accepts noncompetitive bids. On the Reinvestment Edit page, select the button for the security type you wish to edit and click, You'll now see the Reinvestment Request Edit page. See Learn More About Converting Your Paper Bonds. WebWhen your TreasuryDirect account gets locked, you'll need to call the customer service line at 844-284-2676 to have an agent unlock your account. May I move Treasury marketable securities from my Legacy TreasuryDirect account into my new TreasuryDirect account? What happens if I submit matured gift bonds? This will take you to the Account Info Edit page, where you will be able make changes to your information. There's no limit to how much money you can hold, but remember, your Zero-Percent C of I does not earn any interest. Yes.

You may not purchase a Treasury marketable security with a gift registration. Yes. Yes. You've come to the right place. What is a Payroll Zero-Percent Certificate of Indebtedness (Payroll C of I) security? You may designate Zero-Percent C of I as the payment destination when you schedule a redemption. Competitive bidding is only available through the Treasury Automated Auction Processing System (TAAPS) and is therefore not available in TreasuryDirect. The ManageDirect >> Bank Change Form Request page will appear. The account application includes the agreement to accept the tax statement electronically instead of on paper. 6109, which requires us to include this information on certain documents that we must send to the Internal Revenue Service. When a security is transferred from an outside account into a TreasuryDirect account, it will be transferred in the name of the individual account owner in single owner form, regardless of the form of registration prior to the transfer. No. Quarterly interest payments are made on FRNs and sent to your selected payment destination.

We encourage you to contact the receiving financial institution for the correct information. De-linking is not available in entity accounts. Bids higher than the highest accepted rate, yield, or spread are not awarded. No.

This security makes use of an index rate (tied to the most recent 13-week bill rate, prior to the lockout period) and spread (determined at auction) to calculate an interest rate. Other eligible Treasury marketable securities may be scheduled to reinvest one time. No.

In this video, I go over 4 things you should know before opening a Treasury Direct account at TreasuryDirect.gov. Note: View and Transact Rights may also be edited or deleted by clicking the "Edit" or "Delete" button at the bottom of the Assign Rights Detail page. Is there a limit on how much I can invest each year in I Bonds? Once the minor account is de-linked it is deactivated and all new transactions within the minor account are prevented. To De-Link a Minor Account follow the steps below: Note: You will need the account number of the former minors new TreasuryDirect account to complete this process.  The Redemption Confirmation page will be displayed, which indicates your redemption request is completed.

The Redemption Confirmation page will be displayed, which indicates your redemption request is completed.

Please check your account at a later time, as the current interest rate will be displayed as soon as it becomes available. ), If a paper form is not required, the Transfer Review page or Multiple Transfer Review page will be displayed. Choose rights you wish to grant (The page will default to View rights only.

The Payroll Zero-Percent C of I Redemption Confirmation page will be displayed, which indicates your redemption request is completed.

The results of all public auctions are released with details available to view in your TreasuryDirect account after 2 p.m. Eastern Time. Read the statements in the Taxpayer Identification Number Certification box, check the box indicating you agree with the statements, and click. This option is handy when you need to supplement the amount in your C of I for a security purchase. A FRN is a security that has an interest payment that can change over time. You may choose to redeem the full amount or a partial amount. Both products, since they're electronic, can be transferred to another TreasuryDirect account. May I schedule electronic deposits in my Linked accounts?

In order to complete our easy, online application, you will need the following items on hand: a Taxpayer Identification Number (Social Security Number for an individual or Employer Identification Number for an entity), bank routing number and account number (the checking or savings account you'd like to use to set up your TreasuryDirect account), IRS Name Control (for an entity), valid e-mail address, and a browser that supports 128-bit encryption. It is easy to open a Treasury Direct account, to fund it, and get your money out. Series EE Savings Bonds issue dated on or after May 1, 2005 will earn a fixed rate of interest. If the securities are in co-owner form, you will need the consent of the co-owner to change the registration.

See How do I transfer Treasury marketable securities out of my TreasuryDirect account? To sell a Treasury marketable security that is in your TreasuryDirect account, you must transfer the security to a broker/dealer account.

You can definitely open a TreasuryDirect account in the name of your Revocable Living Trust, with yourself as trustee. Is it ever possible for an owner to obtain payment for an EE or I Bond prior to the required holding period?

The Establish a Conversion Account page will appear. Are there different levels of user access?

Holdings for each Linked account are maintained separately from your Primary TreasuryDirect account.

The Bureau of the Fiscal Service is not responsible for any fees your financial institution may charge relating to returned ACH debits.

How do I add a secondary owner or beneficiary to my securities? The semiannual inflation rate is based on changes in the Consumer Price Index for all Urban Consumers (CPI-U), which is reported by the Bureau of Labor Statistics. The interest earned is reported to the IRS for the tax year of the redemption. Under the heading Purchase Information, select your purchase from the list of planned auctions.

A Redemption Confirmation page will be displayed to verify completion of the request. In the form's section 3, check the box for "Transfer to an Established On-Line TreasuryDirect Account Number". You may buy interest-bearing securities with a Zero-Percent C of I by selecting it as a source of funds on Buy Direct. For example, if you had purchased an EE or an I Bond on July 10, the issue date would be July 1. You may change your personalized image/caption at any time. How do I reinvest the proceeds of a maturing security in my TreasuryDirect account? Are there any fees for opening a TreasuryDirect account? Once you've created the desired registration, you'll be brought back to the BuyDirect page or the Payroll Savings Plan page you were originally on with the registration(s) added to the drop-down box. Note: The recipient of a gift bond must have his or her own TreasuryDirect account. A TreasuryDirect individual account owner who has a Conversion Linked account can exchange paper bonds on which he/she is the sole owner, co-owner, or owner with a beneficiary. Learn More About Converting Your Paper Bonds. Yes. Please transfer those bonds to my account.

No. Once you've established a Payroll Savings Plan in your TreasuryDirect account, simply submit a request to your employer to have a regular payroll allotment/direct deposit sent to your account. When you are finished, click the Submit button. Check your account periodically to see if your request has been processed. You may wish to print a copy of this page for your records. A personalized image/caption will help you to know that you are accessing your account on the authentic TreasuryDirect website. For investors to open a new Treasury Direct account, four requirements must be fulfilled, as follows: Investors are required to submit a U.S. Social Security number (or another form of identification such as a Taxpayer Identification Number ). Is there a limit on how much I can invest each year in EE Bonds? Under the heading Manage My Account, click ".

When you have accumulated enough in your Payroll C of I to buy a savings bond, one will be automatically purchased for you.

Scroll down to the heading Treasury Marketable Securities, click the radio button next to the security type you want to edit, and click, On the Current Holdings Summary page, choose the security you wish to edit, and click, At the bottom of the Current Holdings Detail page, click, On the ManageDirect Edit Payment Destination page select the bank account you desire from the drop-down menu for the maturity and/or interest payment destination, and click.

We don't charge any fees for transferring EE and I Bonds. If you have already established your Payroll Savings Plan and wish to edit your registration, product type, or purchase amount, click the "Edit My Payroll Savings Plan link" on the ManageDirect page.

We process these transactions offline. If you wish to create an account for your minor child, select Establish a Minor Linked Account under Manage My Linked Accounts on the ManageDirect page in your Primary Account. No. How many carts can I have? No. How Do I Transfer Securities from Legacy TreasuryDirect to TreasuryDirect. If you submit a matured bond, TreasuryDirect automatically redeems the bond and purchases a Zero-Percent Certificate of Indebtedness in your Primary account with the proceeds. Download the FS Form 5179 from the Forms page on TreasuryDirect here: Fill out the FS Form 5179 form there are detailed instructions starting on page 3 of the form.

No. Try to base your password on a memory aid. (We dont return death certificates or other legal evidence. To do so, you must fill out Form 5444, which is designed to prevent fraud when opening the online TreasuryDirect account. May I cancel a scheduled redemption from my Zero-Percent C of I? Keep in mind, you can provide answers to only three (3) of the security questions.

Learn more about the Payroll Savings Plan. What is the difference between the new TreasuryDirect system and Legacy TreasuryDirect? How long can I hold a gift before delivery? WebTransferring securities from your Legacy TreasuryDirect account to your TreasuryDirect account is just a few steps: Open an account in TreasuryDirect and note your new

Yes. Select from the following list of popular help topics or choose from the other help tools listed in the right-hand May I bid noncompetitively and competitively in the same auction? Securities in a Conversion Linked account (CLA) must first be transferred to a primary or another linked account in order to add a secondary owner. If your financial institution returns the debit a second time, the savings bond will be removed from your account and no further attempt to collect the funds will be made. You may purchase electronic EE or I Bonds for as little as $25 up to $10,000 in penny increments. You'll then see a Confirmation Page listing the details of the purchase, including the Purchase Date and Confirmation Number for each security. For site security purposes, as well as to improve our site, we use software that can monitor network traffic and identify unauthorized attempts to cause damage, upload, or change information. Does my Payroll Zero-Percent C of I security count toward my annual purchase limitation? If, however, you have debited your bank to purchase a C of I, all C of I funds are ineligible for redemption for five business days following the purchase request.

The ManageDirect >> Bank Information >> Add page will appear. Make sure the appropriate button is selected and click. On the Taxable Transactions Summary screen you can view your taxable transactions. Electronic deposits are generally available to use for purchases the business day the funds are received. The C of I does not earn interest and is intended to be used as a source of funds for purchasing eligible interest-bearing securities. Auctions of Treasury securities are offered depending upon the type of security. When the child reaches age 18 and establishes his/her own TreasuryDirect account, you may de-link the securities into the child's new account. U.S. Treasury Bills (T-Bills, Bills) are a type of short-term Treasury marketable security of one year or less, typically sold at a discount.