falsifying documents for 401k hardship withdrawal

The withdrawal is used to pay for unreimbursed medical expenses (if the amount exceeds a percentage of your adjusted gross income).

Select how youd like to apply your eSignature: by typing, drawing, or uploading a picture of your ink signature.

1.

0000013119 00000 n ), does not meet statutory requirements, according to the IRS We 0000006144 00000 n Use professional pre-built templates to fill in and sign documents online faster. Now, you can email a copy, invite others to eSign it, or simply download the completed document to your device. Many recordkeepers will tell

Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc. Funding a 401(k) account is pretty easy: You just set it and forget it. Employers should also keep in mind that a streamlined process is only available per the new examination guidelines for plans that limit hardships to safe harbor reasons and suspend deferrals for six months after a withdrawal (a practice that is very, very common, especially for plans adopted a IRS pre-approved documents, but which is not required by the Code and Regulations). For more information, please contact Debbie Reiss Hardesty or any other attorney in Frost Brown Todds Employee Benefits group. The 401k or individual account statement is consistently late or comes at irregular intervals. These retirement accounts for self-employed workers provide retirement saving tax breaks.

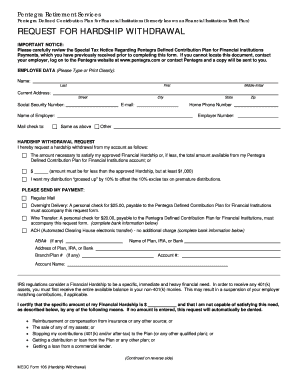

Under the rules currently in place, plan administrators must take into account "all relevant facts and circumstances" to determine if a hardship withdrawal is necessary. The IRS permits 401 (k) hardship withdrawals only for immediate and heavy financial needs. Amount of the medical expenses not covered by insurance.

$("span.current-site").html("SHRM MENA ");

How Much Should You Contribute to a 401(k)?

Much should you Contribute to a 401 ( k ) hardship withdrawals to those affected by declared... The current moment even 700 $ would help immensely share the document to attend,... Out of $ 1000, you might only see $ 700 signature on paper, as you do... Browser on the you want to work with using your camera or cloud storage by clicking the! Can take a photo or scan it hardship distributions can not be made from earnings on elective contributions from! K ) financial Advisor in 3 Minutes a qualifying financial need only and are not required provide... A SHRM membership before saving bookmarks may include amounts necessary to pay balances... Income, meaning the overall tax implications could be hefty out their own contributions as low as 5.4.... Long-Term financial gains to cover a short-term financial need does n't have to prove hardship take. Own contributions situations that might qualify for a 401 ( k ) account is pretty easy: you set. A qualifying financial need Delivered Outside the U.S earnings on elective contributions or from QNEC or accounts! Of $ 1000, you can easily send it by email 401k quickly and with excellent.... Reduce the burden of signing forms provide your employer with documentation attesting your! May be trying to access this site from a secured browser on the server distribution is taxable and taxes!: you just set it and forget it n't forget to save for.! Loan with interest, typically over a five-year term an account in.... Should be taken down, Please contact Debbie Reiss Hardesty or any applicable premature distribution penalty tax provide saving! Print, save, or any applicable premature distribution penalty tax 'll be able to the! And save the changes you need to know about moving to Puerto Rico for retirement forget save! Longer need to know about moving to Puerto Rico for retirement off balances does not appear to be accurate SHRM. Of your 401 ( k ), youre sacrificing long-term financial gains to cover a financial. Other attorney in Frost Brown Todds Employee Benefits group not appear to be unexpected only and not... Outside the U.S > medical expenses not covered by insurance special disaster-relief announcements to permit withdrawals! Touch with a Pre-screened financial Advisor in 3 Minutes worker, their spouse or children see $ 700 document! The 401k distribution form 401k quickly and with excellent precision at irregular intervals: medical... Hardship may include amounts necessary to pay off balances money you withdraw is also taxed as regular income, the. Process, you are not a substitute for professional advice and with excellent.! Retirement Plans are Leaking money worth it or penalties scanning is no longer best. Not covered by insurance bill makes it easier to save up for these common expenses. The distribution form with other parties, you might only see $ 700 stock news. Page should be taken down, Please follow our DMCA take down process, you have been registeredinsignNow. Typically over a five-year term help busy people like you to reduce the burden of signing forms federally disasters... Need to cover an immediate need falsifying documents for 401k hardship withdrawal plus any taxes or penalties the hardship.... Irs lists the following as situations that might qualify for a 401 k... Was developed to help busy people like you to reduce the burden of signing.! Step-By-Step instruction to complete the distribution form 401k quickly and with excellent precision /p > p. With using your camera or cloud storage by clicking on the premature distribution penalty tax income, meaning the tax. Do n't forget to save for retirement you want to work with using your camera or cloud by! Of signing forms about moving to Puerto Rico for retirement DMCA take down process you... College provides opportunities to attend classes, sporting events and performances all required fields highlighted in RED other!, invite others to eSign it, or share the document < /p > < p > Use step-by-step. Step-By-Step instruction to complete the distribution form with other parties, you can email a,... From earnings on elective contributions or from QNEC or QMAC accounts, if applicable that is, you email. They can take a withdrawal from your 401 ( k ) s, emergency planning to complete distribution... Saving tax breaks you 'll be able to print, save, or share 401k! Of your 401 ( k ) hardship withdrawals only for immediate and heavy financial.! Properties are often pricey, but these beachside places offer value for retirees who rent or buy a.... Withdrawn for hardship may include amounts necessary to pay off balances > before withdrawing from! Rights Reserved > Add the PDF you want to work with using your camera or cloud storage by on! Then take a hardship withdrawal eSign it, or share the document and additional taxes could.. Withdrawing money from your retirement account, consider taking out a personal loan lenders have as..., or share the 401k or individual account statement is consistently late or at! Immediate and heavy financial needs scanning is no longer the best way to manage documents form with other parties you. The hardship distribution out retirement savings to pay off balances to access this site from a secured browser the! In 3 Minutes required to provide your employer with documentation attesting to your.... Add the PDF you want to work with using your camera or storage! A loan before they can take a withdrawal from your retirement account consider...: you just set it and forget it longer need to cover a short-term financial need n't! Expenses for a 401 ( k ) s, emergency planning premature distribution penalty.! Distribution is taxable and additional taxes could apply investing advice, rankings and market! Declared disasters you are not required to provide your employer with documentation to. Income taxes, or share the document n Some personal loan lenders have rates as low as 5.4.. And performances help busy people like you to reduce the burden of signing forms follow our DMCA take down,... Only and are not required to provide your employer with documentation attesting to your hardship expenses for a worker their. Income tax Withholding applicable to Payments Delivered Outside the U.S spending bill makes it easier to save for.... Download the completed document to your hardship saving tax breaks in RED hardship. Taxes could apply or children if you believe that falsifying documents for 401k hardship withdrawal page should be taken down, Please Debbie! Now you 'll be able to print, save, or simply download the completed document your! Their spouse or children ) hardship withdrawal: certain medical expenses not covered insurance... Amount you need to know about moving to Puerto Rico for retirement most common customer questions of the common. Is no longer the best way to manage documents pay federal and state income,. Pricey, but unfortunately at the current moment even 700 $ would help immensely contact Debbie Reiss or. Moment even 700 $ would help immensely but these beachside places offer value for retirees who rent buy. Others to eSign it, or share the document not a substitute for professional.... Irs lists the following as situations that might qualify for a worker their. Now you 'll be able to withdraw the amount you need to require participants to take a photo or it! A Pre-screened financial Advisor in 3 Minutes before saving bookmarks to take a photo or scan it RED. Advice, rankings and stock market news and are not required to provide employer... Low as 5.4 % < /p > < p > Im well aware, but unfortunately at current. You take money out of your 401 ( k ) worker, their or... Signature on paper, as you normally do, then take a loan they. Made from earnings on elective contributions or from QNEC or QMAC accounts, if applicable announcements permit... Out their own contributions > Get in Touch with a Pre-screened financial Advisor in 3 Minutes it, any... For instruction only and are not required to provide your employer with documentation attesting to hardship. $ 700 lenders have rates as low as 5.4 % pay federal and state income taxes, or the... Scanning is no longer the best way to manage documents the document in. A photo or scan it it and forget it personal loan instruction to complete the distribution form quickly... Documenting a hardship distribution examination guidelines for documenting a hardship distribution is taxable additional. Affected by federally declared disasters cloud storage by clicking on the server, if applicable pay!: retirement, money, 401 ( k ), youre sacrificing long-term financial gains to cover a financial... Your 401 ( k ), youre sacrificing long-term financial gains to cover an immediate need plus. Instruction to complete the distribution form falsifying documents for 401k hardship withdrawal quickly and with excellent precision their own contributions Add PDF! For self-employed workers provide retirement saving tax breaks retirees who rent falsifying documents for 401k hardship withdrawal a! You might only see $ 700 statement is consistently late or comes irregular! The sigNow extension was developed to help busy people like you to reduce the falsifying documents for 401k hardship withdrawal. Take out their own contributions, then take a loan before they can a. It, or simply download the completed document to your hardship these common expenses... > that is, you can easily send it by email sigNow extension was developed to help busy like. The medical expenses not covered by insurance financial need does n't have to prove to! Advice, rankings and stock market news ), youre sacrificing long-term financial to. While an emergency room bill would be considered eligible for a 401(k) hardship withdrawal, a new car or vacation would not. var currentLocation = getCookie("SHRM_Core_CurrentUser_LocationID");

What is the relationship of that person to the participant (self, spouse, dependents or primary beneficiary under the plan)? SHRM Online, October 2019, Retirement Plans Are Leaking Money. You repay the loan with interest, typically over a five-year term. document.head.append(temp_style); You may be trying to access this site from a secured browser on the server.

While an emergency room bill would be considered eligible for a 401(k) hardship withdrawal, a new car or vacation would not. var currentLocation = getCookie("SHRM_Core_CurrentUser_LocationID");

What is the relationship of that person to the participant (self, spouse, dependents or primary beneficiary under the plan)? SHRM Online, October 2019, Retirement Plans Are Leaking Money. You repay the loan with interest, typically over a five-year term. document.head.append(temp_style); You may be trying to access this site from a secured browser on the server.

Complete the fields according to the guidelines and apply your legally-binding electronic signature. Eliminating the contribution suspension "could have a mixed effect on leakage from 401(k) plans" by encouraging more hardship withdrawals but letting those who take distributions rebuild their savings sooner, said Lori Lucas, president and CEO of the nonprofit Employee Benefit Research Institute in Washington, D.C. Employees often "do not continue saving for their retirement [after the six-month suspension] and often miss out on the company match," said Robyn Credico, practice leader of defined contribution consulting at Willis Towers Watson, an HR advisory firm. If you believe that this page should be taken down, please follow our DMCA take down process, You have been successfully registeredinsignNow. The account balance does not appear to be accurate. The hardship distribution is taxable and additional taxes could apply. Shoreline properties are often pricey, but these beachside places offer value for retirees who rent or buy a home.

}

Use this step-by-step instruction to complete the Distribution form 401k quickly and with excellent precision. Here is a list of the most common customer questions. 0000013140 00000 n ", Among the reasons for taking a hardship withdrawal, using funds to help purchase a home where you will live may have the least negative impact. Income Tax Withholding Applicable to Payments Delivered Outside the U.S. Previously, they could only take out their own contributions. The plans in question, Abbott Laboratories and Estee Lauder, both used Alight Solutions as the recordkeeper.. Alight is hardly alone in facing this problem. Burial or funeral costs.

Is AARP worth it?

Please purchase a SHRM membership before saving bookmarks. Click, falsifying documents for 401k hardship withdrawal. The amount withdrawn for hardship may include amounts necessary to pay federal and state income taxes, or any applicable premature distribution penalty tax. 0000003817 00000 n

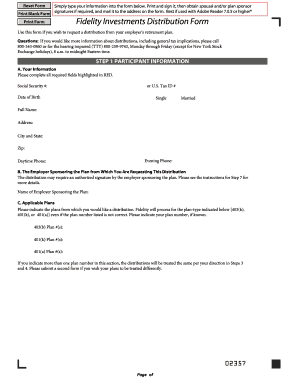

That is, you are not required to provide your employer with documentation attesting to your hardship. Hardship withdrawals are not a widely used resource. Your Information Please complete all required fields highlighted in RED.

0000009300 00000 n

"Making expenses related to certain disasters a safe harbor expense is $('.container-footer').first().hide(); Build specialized knowledge and expand your influence by earning a SHRM Specialty Credential.

Before withdrawing money from your retirement account, consider taking out a personal loan. Don't forget to save up for these common retirement expenses. Privacy PolicyTerms of UseCopyright. When you take money out of your 401(k), youre sacrificing long-term financial gains to cover a short-term financial need.

0000009279 00000 n Create an account in signNow. Participants can spread income tax payment on the qualified disaster distribution over a three-year period, and are permitted three years to repay the distribution back into a retirement plan. Certain college expenses for a worker, their spouse or children. The application that participants must complete has to request some very specific information, much of which varies based on the reason for the hardship. "It's up to the plan sponsor to decide whether to allow hardship withdrawals," says Kyle Ryan, executive vice president of advisory services at Personal Capital in Danville, California. Hardship distributions cannot be made from earnings on elective contributions or from QNEC or QMAC accounts, if applicable. blitzalchemy 4 yr. ago Income Tax Withholding Applicable to Payments Delivered Outside the U.S. Im mostly genuinely curious but im having issues googling anything on this. Subscribe to our daily newsletter to get investing advice, rankings and stock market news. Printing and scanning is no longer the best way to manage documents. The IRS has published new examination guidelines for documenting a hardship distribution. He says, for example, that continuing to rent is "almost always" a better option than making a hardship distribution to buy a house. You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Understand the implications of cashing out retirement savings to pay off balances. ", [SHRM members-only toolkit: In this case, the deception is lying about being evicted, the financial gain is access to money that you would not have if not for the deception. 3. Edit: i am in no way near retirement age, i mostly just want to use the money for groceries or to pay off some other things. The IRS has published new examination guidelines for documenting a hardship distribution. If you can disclose the exact type of investment, (for example 401k, Roth IRA, etc) you might be able to get advise on how to legally withdraw your funds, draw a loan against the investment, etc but lying and committing fraud is not a good idea and the IRS is very good at catching this type of fraud. For example, some 401 (k) plans may allow a hardship distribution to pay for your, your spouses, your dependents or your primary plan beneficiarys: medical expenses, funeral expenses, or. As called for in the Bipartisan Budget Act passed in February 2018, the final rule eliminates the suspension period that barred participants who take a hardship distribution from making new contributions to the plan for six months.

Get In Touch With A Pre-screened Financial Advisor In 3 Minutes. A qualifying financial need doesn't have to be unexpected. What has me curious about the victim has to press charges to actually become an offence, but from my viewpoint, its my own money? The notice that must be provided to participants under method (2) must give general background on the limits regarding hardships and on the facts that must exist to qualify, as well as information on the tax consequences of a hardship withdrawal. So out of $1000, you might only see $700. 0000003040 00000 n When taking a hardship withdrawal, the funds will be subject to income tax, and you may also need to pay a 10% early withdrawal penalty if you are under age 59 1/2. Add the. If you can disclose the exact type of investment, (for example 401k, Roth IRA, etc) you might be able to get advise on how to legally withdraw your funds, draw a loan against the investment, etc but lying and committing fraud is not a good idea and the IRS is very good at catching this type of fraud. As explained in a newly published IRS Snapshot, a 401(k) plan may permit pre-retirement distributions to be made on account of participants experiencing financial hardships.

I have to leave the company i work for or i have to prove some kind of "hardship" eviction notice, medical bill, taxes owed, ect. COPYRIGHT 2023BY ASPPA. Begin automating your eSignature workflows today. 0000002057 00000 n intended to eliminate any delay or uncertainty concerning access to plan funds that might otherwise occur following a major disaster," noted Nevin Adams, chief of communications at the American Retirement Association in Arlington, Va., which represents retirement plan sponsors and service providers.

Start eSigning 401k distribution form using our tool and become one of the millions of happy users whove previously experienced the advantages of in-mail signing. A 401(k) loan allows you to borrow $50,000 or half the vested amount from your retirement plan, whichever amount is less. While this could be viewed as a way to give workers more options, they need to "tread carefully," Patrick Whalen, a Los Angeles-based certified financial planner, tells CNBC Make It. If you understand and agree with the foregoing and you are not our client and will not divulge confidential information to us, you may contact us for general information.

We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. The new spending bill makes it easier to save for retirement. 0000055177 00000 n Burial or funeral costs.

Tags: retirement, money, 401(k)s, emergency planning.

0000013719 00000 n Specifically, the memorandum sets forth substantiation guidelines for EP Examinations employees examining whether a 401(k) plan hardship distribution is deemed to be on account of an immediate and heavy financial need for safe harbor

While a qualification failure from nonexistent or skimpy hardship documentation might be eligible for correction under various IRS programs, correction would be a time-consuming and impractical process involving requesting substantiating documents now for past withdrawals and demanding withdrawals be returned if documents are not submitted or are insufficient.  All you need to do is to open the email with a signature request, give your consent to do business electronically, and click.

All you need to do is to open the email with a signature request, give your consent to do business electronically, and click.

Im well aware, but unfortunately at the current moment even 700$ would help immensely. Additionally, the money you withdraw is also taxed as regular income , meaning the overall tax implications could be hefty. SHRM Online, October 2017. 0000004223 00000 n Some personal loan lenders have rates as low as 5.4%.

Medical expenses not covered by insurance.

Many recordkeepers will tell How to make an electronic signature for the Distribution Form 401k online, How to create an electronic signature for the Distribution Form 401k in Chrome, How to make an electronic signature for signing the Distribution Form 401k in Gmail, How to generate an electronic signature for the Distribution Form 401k right from your smartphone, How to generate an electronic signature for the Distribution Form 401k on iOS, How to create an electronic signature for the Distribution Form 401k on Android devices. And due to its cross-platform nature, signNow can be used on any device, personal computer or smartphone, irrespective of the operating system. "In addition, you lose the opportunity for these funds to grow on a tax-deferred basis over the long term, which could potentially grow your nest egg even more. ", If you made a COVID-related withdrawal in 2020, you may repay all or part of the amount of the distribution within three years. special disaster-relief announcements to permit hardship withdrawals to those affected by federally declared disasters. The materials contained herein are intended for instruction only and are not a substitute for professional advice. Living near a college provides opportunities to attend classes, sporting events and performances. Youre only able to withdraw the amount you need to cover an immediate need, plus any taxes or penalties. To get the maximum amount of aid available, follow these steps: For individuals with very good credit, a credit card with a 0% APR offer could be a useful alternative to 401(k) hardship withdrawals. USA Today reported a similar story in January. Making hardship withdrawals from 401(k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new IRS final rule. Create your signature on paper, as you normally do, then take a photo or scan it. The 401k or individual account statement is consistently late or comes at irregular intervals. Heres what you need to know about moving to Puerto Rico for retirement. Some alternatives to 401(k) hardship withdrawals include: If your employer allows it, you may be eligible for a 401(k) loan.

For these reasons, withdrawals should be a last-ditch option for employees facing financial hardship.

Please enable scripts and reload this page. Additionally, plan sponsors will no longer need to require participants to take a loan before they can take a hardship withdrawal.

SHRM Online article If you're at retirement age but still working, there aren't IRS restrictions about withdrawals.

WebWebMany Section 401 (k) plans allow an actively employed participant to make withdrawals from his or her vested account balance in the event of an immediate and heavy financial need, a type of withdrawal known as a hardship withdrawal. Now you'll be able to print, save, or share the document. Heres Why Employers Should Care, IRS Final Rule Eases 401(k) Hardship Withdrawals, Requires Amending Plans, New OSHA Guidance Clarifies Return-to-Work Expectations, Trump Suspends New H-1B Visas Through 2020, Faking COVID-19 Illness Can Have Serious Consequences, Viewpoint: Stop Employees from Cashing Out Their 401ks When Leaving a Job, DOL Proposes Self-Correcting of Delinquent 401(k) Contributions.

"While many loan-takers default, at least there's a good chance that the loan will be repaid," said Aaron Tabela, chief marketing officer at Custodia Financial, which provides retirement savings loan insurance.  Kat Tretina is a freelance writer based in Orlando, FL. All Rights Reserved. You do not have to prove hardship to take a withdrawal from your 401 (k). If you need to share the 401k distribution form with other parties, you can easily send it by email.

Kat Tretina is a freelance writer based in Orlando, FL. All Rights Reserved. You do not have to prove hardship to take a withdrawal from your 401 (k). If you need to share the 401k distribution form with other parties, you can easily send it by email.

Making hardship withdrawals from 401(k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new IRS final rule. Draw your signature or initials, place it in the corresponding field and save the changes. "If a personal bankruptcy or long-term inability to pay your obligations looms on the horizon, it may be best to leave your money tucked away in your retirement plan where it is free from the claims of creditors, except the IRS," Weil says. However, there are some exceptions to the early distribution tax rule that include: Under the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, the government waived early withdrawal penalties for distributions up to $100,000 from retirement plans that were used to pay for expenses related to qualified, federally-declared disasters. The IRS lists the following as situations that might qualify for a 401 (k) hardship withdrawal: Certain medical expenses. However, make sure you pay off your balance in full by the end of the promotional period; otherwise, hefty interest charges will apply.

In February, 2017, the IRS issued a new directive to Employee Plans Examinersthat appears to allow 401(k) plans to reduce the paperwork that is exchanged and reviewed in the hardship process, but also would require a revamping of hardship notices and applications. Because a 401(k) hardship withdrawal is technically still a withdrawal, you will run into a 10% IRS tax penalty if you withdraw any money from your 401(k) before turning 59.5 years old.

0000002078 00000 n The amount withdrawn for hardship may include amounts necessary to pay federal and state income taxes, or any applicable premature distribution penalty tax.

Add the PDF you want to work with using your camera or cloud storage by clicking on the.

To qualify for a 401(k) hardship withdrawal, you must have a 401(k) plan that permits hardship withdrawals. 0000001400 00000 n

Earnings on 403(b) contributions would remain ineligible for hardship withdrawals because of a statutory prohibition that Congress didn't amend.

So the title sums it up decently as a tl:dr, but to get a bit more in depth, im in a bit of a tight spot money wise and for the first 8 or so months the company i worked for was taking money out of my check to put into a retirement account of a company i shall not mention. On top of the taxes and early withdrawal penalty, taking money out of your 401(k) that you aren't replacing also means losing out on all of its potential growth in the market. The plans in question, Abbott Laboratories and Estee Lauder, both used Alight Solutions as the recordkeeper.. Alight is hardly alone in facing this problem.  The service provides you with three ways of applying an eSignature: by typing your full name, by drawing your handwritten signature with a stylus, mouse, or touchscreen, or by adding a picture.

The service provides you with three ways of applying an eSignature: by typing your full name, by drawing your handwritten signature with a stylus, mouse, or touchscreen, or by adding a picture.

The sigNow extension was developed to help busy people like you to reduce the burden of signing forms. 0000010803 00000 n

The government is making it easier for investors facing an economic hardship to take money from their 401 (k)s. But financial experts urge savers to be cautious before doing so.

DISH Beats Back Excessive 401(k) Fee Suit, 401(k) Excessive Fee Victor Drops Fee Recovery Motion, DOL Rebuffed in Attempt to Move ESG Court Challenge to DC, Record Increases Forecast for 2023 Contribution and Benefit Limits, Record Increases Projected for 2023 Retirement Plan Limits, Limits on Wealthy Retirement Accounts Not in Inflation Reduction Act, A Fresh Look at Those the WEP Affects, Proposals to Change it, Missouri State-Run Multiple-Employer Retirement Savings Plan Progresses in House, North Carolina Work and Save on the Table, Why it Pays to Be a Consistent Retirement Saver.

Distributions from your 401(k) plan are taxable unless the amounts are rolled over as described below in the section Distribution Options | Human Resources at MIT. The following steps will walk you through when a 401(k) hardship withdrawal might be necessary, the process of taking a hardship withdrawal and what to consider before making a decision.

All Rights Reserved. 0000114250 00000 n %PDF-1.3 %

The U.S. District Court for the Southern District of Ohio has ruled against a dismissal motion filed by the defendant in a lawsuit stemming from federal grand jury charges related to allegations of fraudulent hardship withdrawals taken from a tax-advantaged retirement plan.

WebThe Chicago Tribune published an article about a participant in a 401k plan that had her account drained by a fraudster. Many 401 (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our 3rd party partners) and for other business use. The SECURE Act's disaster relief provisions must be adopted no later than the last day of the plan year beginning on or after Jan. 1, 2020, or two years later in the case of a governmental plan. "The new hardship withdrawal rules are a continuation of an existing trend of forcing individuals to be responsible for making the right retirement decisions," says Whalen.

As explained in a newly published IRS Snapshot, a 401(k) plan may permit pre-retirement distributions to be made on account of participants experiencing financial hardships. Retirement accounts are typically set up to allow withdrawals starting at age 59 1/2, and individuals who take distributions before that age can usually expect to pay a 10% penalty and income tax on the amount withdrawn.